Research Methodology on Data Centre Market

A systematic and detailed research methodology is employed in order to study the data center market size and potential of the global data center market. This research methodology involves various steps including primary and secondary data collection methods, competitive analysis, market sizing & estimation, market scenario analysis and final market assessment.

Data Collection

Primary data is collected from interviews of key players, industry experts and relevant stakeholders in the data center market. In addition, secondary data is collected from major industry databases such as Bloomberg, Factiva, Hoovers, Plunkett and Frost & Sullivan. The data is used to analyze the present market size, trends and future estimates.

Market Sizing & Forecasting

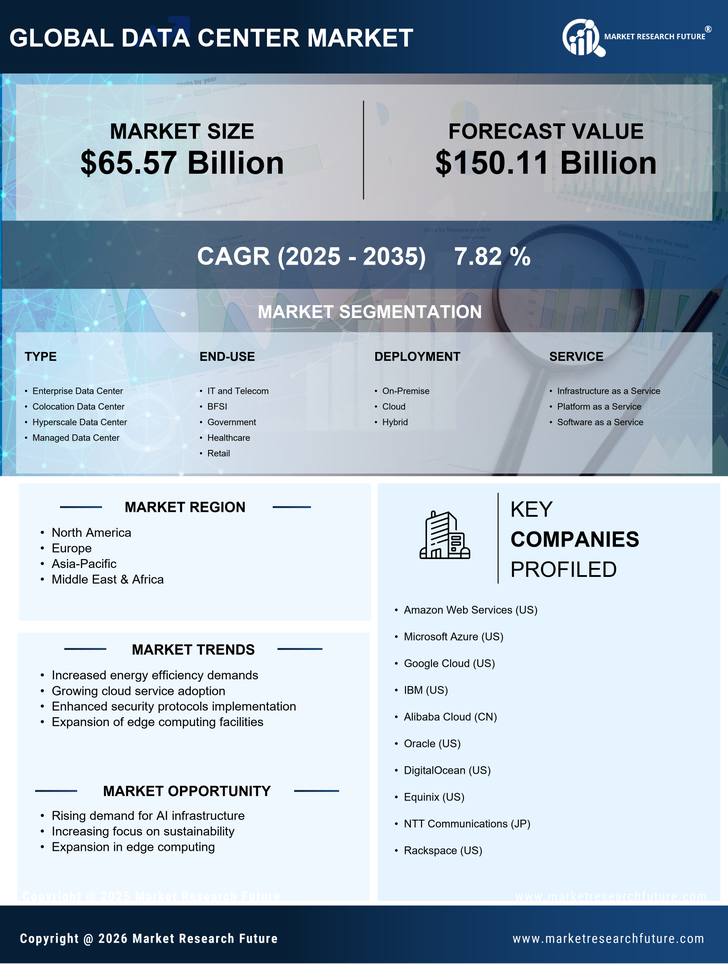

Market sizing and forecasting are performed using econometric models that are based on the market components, such as demand/ supply, customer/ company dynamics, competitive landscape, and economic conditions. The models are detailed in the report and help in forecasting the data center market size from 2023 to 2030.

Competitive Analysis

The competitive landscape in the global data center market is examined by analyzing the intensity of bankruptcy, market share, industry trends, payer mix, customer mix, country mix, personnel mix, product mix and end-use mix. This analysis helps in understanding the competitive scenario and how it impacts the data center market landscape.

Market Scenario

In order to assess the market scenario of the global data center market, MRFR used Porter's 5 Forces Model, PEST Analysis and Customer Buying Behaviour Matrix. These models provide insights into the drivers, restraints, opportunities and threats in the market.

Final Market Assessment

The analysis and data collected is used to forecast the global data center market's market size and potential. The forecasts are validated using the narrative and historical method. The final market assessment is based on the forecast and analysis, which gives an overall picture of the market in the next seven years.

Conclusion

The research methodology employed in this study helps in understanding the overall market size and potential of the global data center market. Primary and secondary data is collected and analyzed to assess the current market situation and projected scenarios for the next five years. Porter's 5 Forces Model, PEST Analysis and Customer Buying Behaviour Matrix are utilized to gain insights into the drivers, restraints and opportunities in the data center market. The final market assessment is based on the forecast and analysis, which gives an overall picture of the market in the next seven years (2023 to 2030).