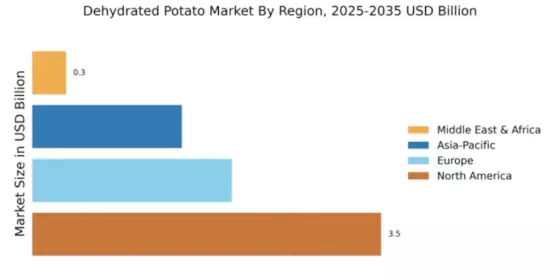

North America : Market Leader in Dehydrated Potatoes

North America continues to lead the dehydrated potato market, holding a significant share of 3.5 billion. The growth is driven by increasing consumer demand for convenience foods and the rising popularity of plant-based diets. Regulatory support for food safety and quality standards further enhances market stability. The region's advanced supply chain and distribution networks also contribute to its robust market position.

The United States is the primary player in this region, with major companies like McCain Foods, Lamb Weston, and Simplot dominating the landscape. These firms leverage innovative processing techniques and extensive distribution channels to meet growing consumer needs. The competitive environment is characterized by strategic partnerships and product diversification, ensuring a steady supply of high-quality dehydrated potato products.

Europe : Emerging Market with Growth Potential

Europe's dehydrated potato market is valued at €2.0 billion, reflecting a growing trend towards convenience and health-conscious eating. The demand is fueled by increasing consumption of ready-to-eat meals and snacks, alongside a shift towards sustainable food practices. Regulatory frameworks in the EU promote food safety and quality, which are crucial for market growth and consumer trust.

Leading countries in this region include Germany, the Netherlands, and France, where companies like Agrarfrost and Oerlemans Foods are key players. The competitive landscape is marked by innovation in product offerings and sustainability initiatives. The presence of established brands and a focus on quality assurance further enhance the market's attractiveness, positioning Europe as a significant player in the global dehydrated potato sector.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing rapid growth in the dehydrated potato market, currently valued at $1.5 billion. This growth is driven by urbanization, changing dietary habits, and an increasing preference for processed foods. Regulatory bodies are also promoting food safety standards, which are essential for market expansion. The region's diverse culinary preferences further enhance the demand for dehydrated potato products.

Countries like China, India, and Japan are leading the market, with local and international players competing for market share. Companies such as Simplot and Idahoan Foods are expanding their presence through strategic partnerships and localized product offerings. The competitive landscape is evolving, with a focus on innovation and meeting the unique tastes of consumers in this diverse region.

Middle East and Africa : Untapped Market with Growth Opportunities

The Middle East and Africa region represents an untapped market for dehydrated potatoes, currently valued at $0.34 billion. The growth potential is driven by increasing urbanization, rising disposable incomes, and a growing demand for convenience foods. Regulatory frameworks are gradually improving, which is essential for attracting investment and enhancing market stability.

Countries like South Africa and the UAE are emerging as key players in this market. The competitive landscape is characterized by a mix of local and international companies, with a focus on product innovation and quality. As consumer preferences shift towards healthier options, the presence of key players like Farm Frites is expected to drive market growth in the coming years.