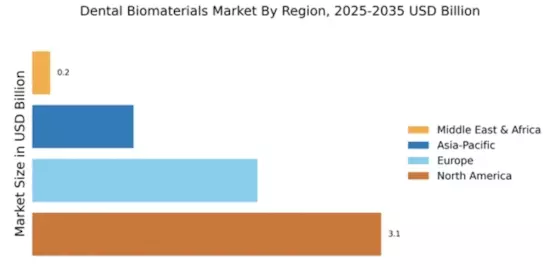

Market Growth Projections

The Global Dental Biomaterials Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 3.57 USD Billion in 2024 and further expand to 7.8 USD Billion by 2035, the industry is on a promising trajectory. This growth is underpinned by a compound annual growth rate of 7.36% from 2025 to 2035, indicating a robust demand for dental biomaterials. Factors such as technological advancements, increasing awareness of oral health, and a growing geriatric population contribute to this upward trend. The market dynamics suggest a vibrant future for dental biomaterials.

Increasing Geriatric Population

The Global Dental Biomaterials Market Industry is poised for growth due to the increasing geriatric population worldwide. As individuals age, they often experience dental issues that require restorative treatments, including implants and dentures. The demand for biomaterials that cater to this demographic is rising, as older adults seek solutions that enhance their quality of life. This demographic shift is expected to drive market expansion, with a projected compound annual growth rate of 7.36% from 2025 to 2035. Consequently, manufacturers are likely to focus on developing materials specifically designed for the unique needs of older patients.

Growing Awareness of Oral Health

The Global Dental Biomaterials Market Industry benefits from a growing awareness of oral health among consumers. Educational initiatives and public health campaigns emphasize the importance of maintaining good oral hygiene, leading to increased dental visits and procedures. This heightened awareness encourages individuals to invest in preventive and restorative dental care, thereby boosting the demand for various biomaterials. As consumers become more informed about the options available, the market is likely to see a rise in the adoption of advanced materials that offer better performance and longevity. This trend suggests a positive outlook for the industry in the coming years.

Rising Demand for Aesthetic Dentistry

The Global Dental Biomaterials Market Industry experiences a notable surge in demand for aesthetic dentistry. Patients increasingly seek procedures that enhance their smiles, driving the adoption of biomaterials such as ceramics and composites. These materials not only provide functional benefits but also improve the aesthetic appeal of dental restorations. As a result, the market is projected to reach 3.57 USD Billion in 2024, reflecting the growing consumer preference for visually pleasing dental solutions. This trend indicates a shift towards more personalized dental care, where aesthetics play a crucial role in treatment decisions.

Regulatory Support and Standards Development

Regulatory support plays a crucial role in shaping the Global Dental Biomaterials Market Industry. Governments and health organizations are increasingly establishing standards and guidelines for the use of dental biomaterials, ensuring safety and efficacy. This regulatory framework fosters innovation and encourages manufacturers to invest in research and development. As a result, the market is likely to witness the introduction of new and improved biomaterials that meet stringent safety requirements. Such developments not only enhance consumer confidence but also contribute to market growth, as dental professionals are more inclined to adopt materials that comply with established standards.

Technological Advancements in Dental Materials

Technological innovations significantly influence the Global Dental Biomaterials Market Industry. Advances in material science have led to the development of superior biomaterials that offer enhanced properties such as biocompatibility, strength, and durability. For instance, the introduction of 3D printing technology allows for the precise fabrication of dental implants and prosthetics, improving patient outcomes. These advancements not only streamline the production process but also reduce costs, making dental treatments more accessible. As the industry evolves, it is likely that these technologies will further propel market growth, contributing to an anticipated market value of 7.8 USD Billion by 2035.