Market Analysis

In-depth Analysis of Dental Services Market Industry Landscape

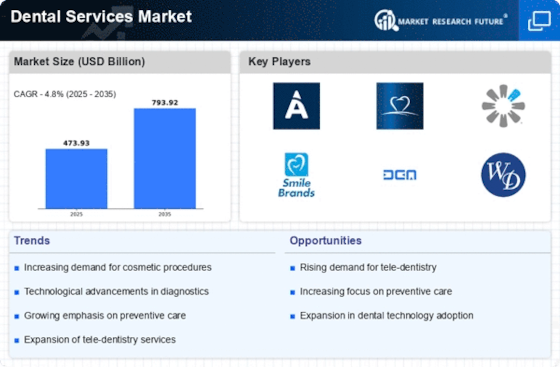

The dental services market is affected by different variables that show the intermingling of oral wellbeing mindfulness, mechanical progressions, segment changes, and developing customer inclinations. A significant variable driving the development of this area is the developing acknowledgment of the meaning of oral wellbeing and its impact on comprehensive prosperity. The rising mindfulness among people with respect to preventive medical care has prompted a developing interest for routine dental assessments, cleanings, and other preventive administrations. This, thus, has added to the development of the dental services market. Mechanical headways in the field of dentistry, like computer aided design/CAM structures, high level imaging, and laser dentistry, have altogether changed examination and treatment strategies, bringing about better accuracy, proficiency, and patient fulfilment. Interest for dental services tending to mature related oral wellbeing concerns and restorative dentistry is impelled by market elements impacted by segment changes, like a maturing populace and an expanded accentuation on stylish dentistry. The market is altogether influenced by the administrative climate, which guarantees thorough authorizing and license necessities for dental experts, subsequently moulding activities, administration quality, and market notoriety. Monetary determinants, for example, discretionary cashflow and medical services use apply a significant effect on the elements of the dental market, in this way impacting openness and usage, as well as filling interest for corrective and elective strategies. Experts, research organizations, and producers take part in overall joint effort in dental wellbeing to propel treatment modalities, materials, and advancements, in this manner guaranteeing that proof-based dentistry is as per the latest examination disclosures. Especially in the domain of oral wellbeing, public mindfulness crusades apply a significant effect on market elements by laying out associations between oral wellbeing and foundational illnesses, rousing steady dental participation, and advancing proactive oral medical services. The dental services area is portrayed by extraordinary contest, as centers endeavour to offer inventive treatment choices, specific administrations, and the coordination of new advances. Market elements are impacted by purchaser inclinations, by which dental administrations require computerized correspondence, helpful planning, and an ideal patient encounter. Rehearses that execute innovation and patient-focused procedures are all the more actually situated to satisfy these assumptions. Moderateness and openness influence the elements of the dental market by means of center conveyance, reasonable protection, and support in wellbeing plans. Tending to aberrations in oral wellbeing and increment accessibility is fundamental.

Leave a Comment