Dental Services Size

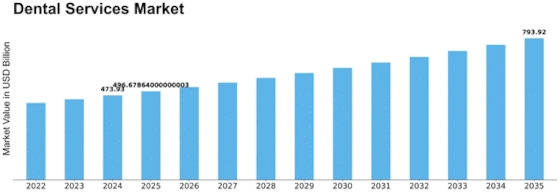

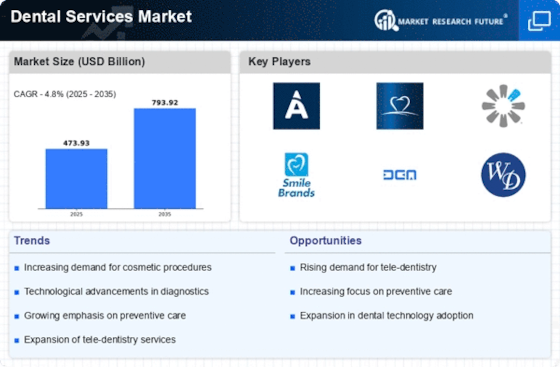

Dental Services Market Growth Projections and Opportunities

Various variables impact the dental services market, for example, the developing public awareness concerning oral wellbeing and the worth of routine dental support. The complete extension of the market is worked with by the rising interest for proactive dental administrations and normal check-ups as open mindfulness increments. The improvement of innovation plays had an essential impact in moulding the dental services industry. Drawn out progressions in dental advancements, including computer aided design/CAM frameworks, advanced imaging, and laser dentistry, have modified demonstrative and restorative strategies. These mechanical progressions increment accuracy, effectiveness, and patient fulfilment in dental administrations, accordingly, reassuring the reception of modern methods. The extension of the dental administrations market is impelled by the maturing of the worldwide populace, which increments interest for helpful and restorative techniques and stresses the significance of by and large wellbeing. Government strategies and guidelines apply a significant effect on the dental services market by setting treatment norms and advancing oral wellbeing. Consistence guarantees market honesty, patient wellbeing, and certainty. The reasonableness and use of dental services are affected by monetary factors like protection inclusion, extra cash, and financial circumstances. Monetary slumps can possibly actuate both transient decays and supported development on the lookout. Dental services industry is an arising peculiarity that attracts patients from around the world hunt of savvy dental consideration in districts offering serious rates. Subsequently, the market for dental services is turning out to be all the more around the world incorporated. The cutthroat scene of the industry is moulded by elements like practice separation, patient experience, and contemporary plans of action. Various patients are drawn in using computerized advertising, patient-driven approaches, and cutting-edge innovations. By coordinating state of the art innovation, directing exploration, and arranging preparing programs, worldwide joint efforts among innovation organizations, dental specialist co-ops, and scholastic foundations work with market development and increment patient admittance to cutting edge medicines. The reception of dental services is invigorated by open mindfulness crusades and instructive drives, which thus raise the interest for preventive and restorative administrations and advance a proactive position towards oral wellbeing. The market for dental services was significantly impacted by the Coronavirus pandemic, which made lockdowns, security concerns, and disturbances. Endeavours to recuperate involve changing in accordance with novel guidelines and redressing overabundances.

Leave a Comment