Market Analysis

In-depth Analysis of Dental Sleep Medicine Market Industry Landscape

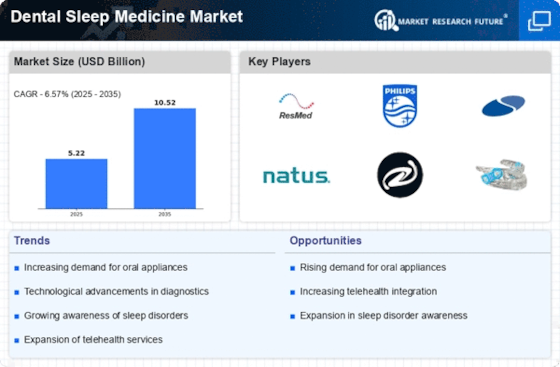

Market analysis of the Dental Sleep Medicine (DSM) market involves a comprehensive examination of various factors that influence its dynamics, growth, and competitive landscape. One crucial aspect is the increasing prevalence of sleep-related disorders, particularly sleep apnea, driving the demand for effective solutions. The market analysis reveals a notable shift in treatment preferences, with a growing acceptance of oral appliances over traditional Continuous Positive Airway Pressure (CPAP) machines. The effectiveness and comfort of these custom-fitted devices contribute to their popularity among patients seeking alternative and patient-friendly options.

Technological advancements play a pivotal role in market analysis, showcasing a trend towards digitalization in DSM. The integration of advanced technologies such as 3D imaging and digital impressions has significantly improved diagnostics and treatment planning. This not only enhances the precision of oral appliance customization but also streamlines the overall patient experience. The market analysis indicates a positive correlation between technological innovation and the growth of DSM, as practitioners and patients alike benefit from more efficient and accessible solutions.

Collaborative care models emerge as a key factor in the market analysis of Dental Sleep Medicine. Dentists and sleep specialists working together create a synergistic approach to identifying, diagnosing, and treating sleep-related issues. This collaboration ensures a more holistic and coordinated patient care strategy, positively impacting the overall quality of care. Market analysis suggests that this trend fosters the integration of DSM services into the broader healthcare ecosystem, expanding the reach and impact of these specialized services.

Market segmentation is a crucial aspect of the analysis, recognizing that different regions may exhibit unique challenges and opportunities. Urban areas, with higher concentrations of healthcare facilities, tend to be more advanced in DSM adoption, while rural areas may face barriers such as limited access to specialized care. Market analysis assists in identifying these regional variations, allowing for targeted efforts to bridge gaps and improve accessibility to DSM services across diverse geographic landscapes.

The analysis of the aging population emerges as a demographic factor influencing the DSM market. As the population ages, there is a natural increase in the prevalence of sleep-related disorders. Market analysis highlights the importance of tailoring DSM approaches to address the specific needs and considerations of older adults. This demographic trend represents a substantial market for DSM services, emphasizing the necessity of adapting strategies to cater to the unique challenges associated with an aging population.

Competitive analysis within the Dental Sleep Medicine market reveals a diverse landscape of manufacturers and service providers offering a range of oral appliances and treatment options. Market analysis indicates that companies strive to differentiate themselves based on the effectiveness of their products, patient satisfaction, and the ability to adapt to evolving technological and healthcare trends. As the market becomes more competitive, innovation becomes a driving force, with companies continuously improving existing products and developing new solutions to capture and retain market share.

Leave a Comment