Market Share

Dental Sleep Medicine Market Share Analysis

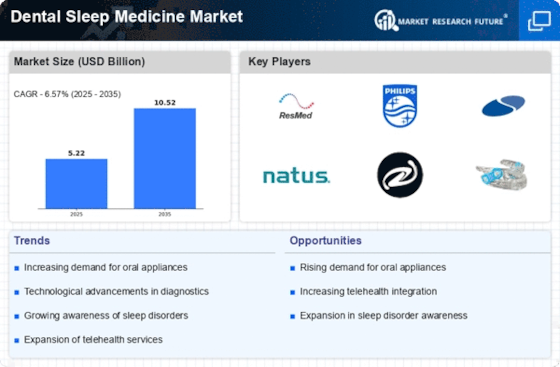

The Dental Sleep Medicine market has become a pivotal player in the broader healthcare landscape, witnessing a steady evolution in market share over recent years. As awareness about sleep-related disorders grows, so does the demand for effective solutions, and Dental Sleep Medicine has carved out a significant portion of this expanding market. The market share for Dental Sleep Medicine is influenced by various factors, with the efficacy of oral appliances in treating sleep-disordered breathing playing a central role. These custom-fitted devices, designed to reposition the jaw and maintain an open airway during sleep, have gained popularity among patients seeking an alternative to traditional treatments like CPAP machines.

In terms of market dynamics, the collaborative efforts between dental professionals and sleep specialists have contributed to an increase in market share. Dentists, often the first point of contact for patients, play a crucial role in identifying and referring individuals with potential sleep-related issues. This collaboration enhances the overall patient care continuum, reinforcing the market position of Dental Sleep Medicine as a vital component of comprehensive healthcare.

The technological advancements in diagnostics and treatment planning have also played a pivotal role in shaping the market share of Dental Sleep Medicine. The integration of 3D imaging, digital impressions, and other cutting-edge technologies has not only improved the accuracy of diagnosis but has also streamlined the process of creating customized oral appliances. As technology continues to advance, the market share of Dental Sleep Medicine is likely to expand further, attracting both practitioners and patients seeking innovative and efficient solutions.

Furthermore, market share is influenced by the increasing recognition of the connection between oral health and overall well-being. Dental Sleep Medicine's holistic approach aligns with the broader trend in healthcare, addressing not only the immediate dental concerns related to sleep disorders but also considering the systemic health implications. This comprehensive perspective resonates with patients and contributes to the market share growth as more individuals prioritize integrated healthcare solutions.

The competitive landscape within the Dental Sleep Medicine market is shaped by the presence of various manufacturers and service providers offering a range of oral appliances and treatment options. Market share is influenced by factors such as the effectiveness of the products, patient satisfaction, and the ability to adapt to evolving technological and healthcare trends. As the market becomes more competitive, companies are driven to innovate, improving existing products and developing new solutions to capture and retain a larger market share.

Leave a Comment