Diabetes Pen Size

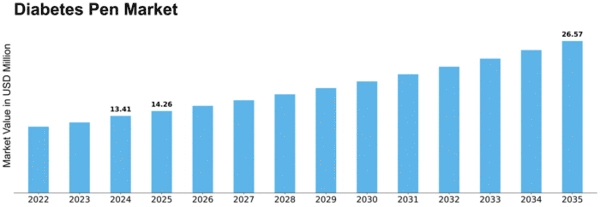

Diabetes Pen Market Growth Projections and Opportunities

The Americas Diabetes Pen Market is influenced by a myriad of factors that collectively define its growth and dynamics. One of the primary drivers is the increasing prevalence of diabetes in the Americas. As the number of individuals diagnosed with diabetes continues to rise, there is a growing demand for convenient and effective insulin delivery methods, driving the adoption of diabetes pens. These devices offer a user-friendly alternative to traditional insulin injections, allowing patients to manage their diabetes more comfortably and with greater precision, contributing to the expansion of the market.

Research and development activities play a crucial role in shaping the Americas Diabetes Pen Market. Ongoing advancements in medical technology and pharmaceutical formulations drive innovation in diabetes pens. Companies invest in developing pens with enhanced features, improved insulin delivery mechanisms, and smart technologies that facilitate better diabetes management. Continuous research efforts contribute to the availability of a diverse range of diabetes pens, meeting the evolving needs of patients and healthcare providers.

Government regulations and healthcare policies significantly impact the Americas Diabetes Pen Market. Regulatory approvals are essential for the introduction of new diabetes pens and related technologies. Compliance with regulatory standards ensures the safety and efficacy of these devices, instilling confidence among healthcare professionals and patients. Government policies related to diabetes management, reimbursement for insulin pens, and initiatives promoting the use of advanced technologies influence market dynamics, affecting the adoption and utilization of diabetes pens.

The role of healthcare infrastructure and access to diabetes care services is pivotal in the Americas Diabetes Pen Market. Well-established healthcare facilities, diabetes clinics, and trained healthcare professionals support the integration of diabetes pens into routine diabetes management. Accessibility to diabetes care services influences the adoption of diabetes pens, with improved infrastructure contributing to the overall growth of the market.

Market competition is a significant factor driving innovation in the Americas Diabetes Pen Market. The presence of various pharmaceutical and medical device companies fosters competition, leading to the development of diverse diabetes pen technologies and products. Companies strive to offer pens that provide accurate dosing, ease of use, and enhanced portability, addressing the preferences of patients and healthcare professionals. The competitive landscape encourages continuous improvement in diabetes pen features, benefiting the field of diabetes care.

Public awareness and changing trends in diabetes management contribute to the dynamics of the Americas Diabetes Pen Market. With a growing emphasis on personalized and convenient diabetes care, patients and healthcare providers are increasingly aware of the benefits of using diabetes pens. Educational initiatives by medical professionals and industry stakeholders further drive awareness, highlighting the role of pens in simplifying insulin administration and improving adherence to treatment regimens.

Global economic conditions and healthcare spending patterns influence the Americas Diabetes Pen Market. Economic factors impact funding for research and development, market access, and affordability of diabetes pens. As healthcare budgets vary across countries in the Americas, economic considerations play a role in shaping the adoption and utilization of diabetes pens in different healthcare settings.

The ongoing COVID-19 pandemic has presented challenges and opportunities for the Americas Diabetes Pen Market. While the pandemic has strained healthcare resources and shifted priorities, it has also highlighted the importance of remote and self-administered diabetes care. The adaptability of diabetes pens in home-based settings may position them favorably as healthcare systems evolve to accommodate changing healthcare needs.

Leave a Comment