Research Methodology on Diameter Signalling Market

Introduction

The Diameter Signalling Market is a segment of the telecom market which deals with signalling for internet protocol (IP) services; it is an application signalling protocol used for providing enhanced services to mobile phone subscribers. It is based on the Internet Protocol (IP) core network and designed to provide secure global roaming, user authentication, access control and more.

In order to gain a better understanding of the dynamics of the diameter signalling market and its associated trends, a research is required to analyze the current and future market trends, competition and regional dynamics. Therefore, this research intends to study the socio-economic and technological factors driving the diameter signalling market along with its drivers and restraints.

Aims and objectives

The aim of this research is to gain a comprehensive understanding of the global Diameter Signalling Market in terms of its market size, segmentation, drivers and restraints, and other associated dynamics.

The primary objectives of the research are to:

- Analyze and forecast the diameter signalling market size by type of product, technology and application

- Explore the key drivers and restraints associated with the market

- Combine data-analysis with market insights

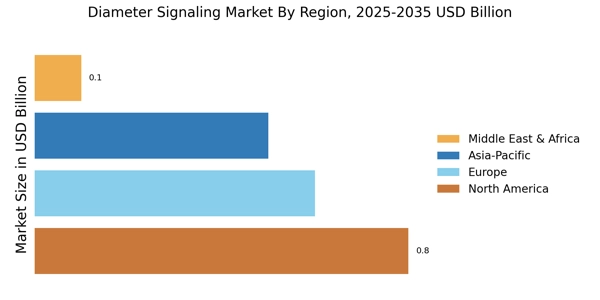

- Explore geographical and regional trends in the industry

- Profile the key players in the market

Research methodology

In order to understand the industry dynamics and the forces driving the market, the research methodology combines data-analysis with market insights and assessment. The research data and market information are collected from publicly available reports, nationally published data and internationally published data.

Secondary research

Secondary research is used to collect information from existing databases, including publicly available reports, magazines, newspapers, and other sources. This data is then put into perspective, thereby providing a platform for the primary research.

Primary research

Primary research is used for in-depth analysis of the diameter signalling market. This includes interviews of key industry participants and surveys with industry experts and suppliers.

Survey Methodology

The survey methodology utilized in this research includes surveys with industry experts and vendors as well as questionnaire-based surveys of market participants and investigators. The questionnaire comprises questions on their organization, product preferences, and other industry related information.

Data Warehousing

A data warehouse is a framework of integrated data structures and processes to store, share, retrieve and analyze data. It helps in retrieving data easily without having to search several sources.

Data Analysis

The data is analyzed to identify patterns, trends and associations in the data obtained from primary and secondary sources. This helps in gaining insights into the diameter signalling market.

Data Validation

To validate the accuracy of the data, a process of validation is followed. The data is crosschecked, compared and reviewed by experts.

Result Analysis and Discussion

The results obtained from the data, analysis and validation are discussed in detail. The results are interpreted to come to valid conclusions about the diameter signalling market.

Conclusion

The research is concluded by providing an assessment of the findings. A summary of key points and trends is provided for a better understanding of the diameter signalling market.