Diesel Genset Size

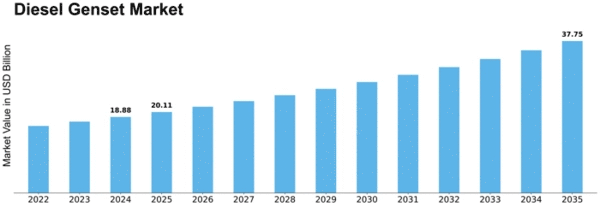

Diesel Genset Market Growth Projections and Opportunities

The diesel genset market is influenced by various market factors that impact its growth, demand, and trends. These factors play a crucial role in shaping the dynamics of the market, affecting both suppliers and consumers. One significant factor is the rise in power outages due to aging infrastructure and unpredictable weather conditions. As frequent blackouts become more common, businesses and homeowners seek reliable backup power solutions, driving up the demand for diesel gensets.

Additionally, the expansion of industries such as construction, manufacturing, healthcare, and telecommunications fuels the need for continuous power supply, further boosting the diesel genset market. These sectors often require uninterrupted power to sustain operations, making diesel gensets a vital investment for them. Moreover, the growing demand for off-grid power solutions in remote areas and developing regions contributes to the market's expansion.

Government initiatives and regulations also play a significant role in shaping the diesel genset market. Policies aimed at reducing carbon emissions and promoting clean energy solutions impact the adoption of diesel gensets. In response to environmental concerns, manufacturers are innovating to develop more efficient and eco-friendly genset models, meeting stringent emission standards imposed by regulatory bodies. However, the implementation of emission regulations varies across regions, creating a complex landscape for market players to navigate.

Economic factors such as GDP growth, infrastructure development, and investment in critical sectors influence the demand for diesel gensets. Strong economic growth typically correlates with increased construction activities, industrial expansion, and infrastructure projects, driving the need for reliable power backup solutions. Conversely, economic downturns or recessions may temporarily slow down market growth as businesses tighten their budgets and postpone capital expenditures.

Technological advancements also shape the diesel genset market, driving innovation and product development. Manufacturers are investing in research and development to enhance genset efficiency, reliability, and performance. Integration of smart technologies, such as remote monitoring and predictive maintenance systems, improves genset functionality and reduces downtime, appealing to consumers seeking advanced solutions.

Furthermore, fluctuations in fuel prices impact the operating costs of diesel gensets and influence consumer purchasing decisions. Volatile fuel prices can lead consumers to explore alternative power solutions or invest in energy-efficient genset models to mitigate long-term operational expenses. Additionally, the availability and accessibility of fuel infrastructure play a crucial role in determining the feasibility of diesel genset deployment in different regions.

Market competition and industry consolidation also shape the diesel genset market landscape. Key players continually strive to differentiate their products through innovation, quality, and service offerings to gain a competitive edge. Mergers, acquisitions, and strategic partnerships are common strategies employed by companies to expand their market presence and enhance their product portfolios.

Lastly, demographic trends and societal shifts impact the diesel genset market, particularly in residential and commercial segments. The increasing urbanization and population growth drive the demand for reliable power solutions in densely populated areas, where grid reliability may be lower. Moreover, changing consumer preferences towards energy independence and sustainability influence the adoption of diesel gensets equipped with hybrid or renewable energy integration capabilities.

The diesel genset market is influenced by a myriad of factors, including power outage frequency, industry growth, government regulations, economic conditions, technological advancements, fuel prices, market competition, and demographic trends. Understanding and adapting to these market factors are essential for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities.

Leave a Comment