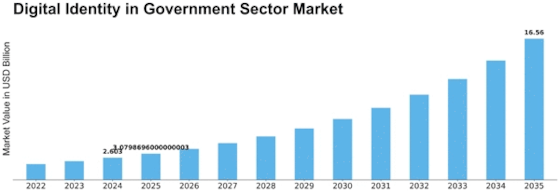

Digital Identity In Government Sector Size

Digital Identity in Government Sector Market Growth Projections and Opportunities

The market dynamics of digital identity are shifting significantly in the government sector as the world moves towards digital governance and as well as the need for efficient and secure public services increases. Concerning delivery of services at levels never seen before, national governments have been adopting new solutions that promote transparency and mitigate risks to their citizens. Several key factors contribute to the evolving dynamics of the digital identity market in the government sector.

One of the main drivers is e-Government initiatives which insist on strong identification procedures that play a fundamental role in facilitating an online interaction between citizenry and administrative structures. To guarantee that users are genuine, there has to be solid verification of their identities as they shift towards online platforms such as tax filing, licenses renewals among others. This involves use of biometric data or other means intended for creating a secure and user-friendly space where people can interact with government through various platforms.

Similarly, market forces around global terrorism also shape this sector greatly by influencing countries’ policies towards promotion of nation’s security. Governments globally are investing in advanced identity verification technologies to strengthen border control, counter terrorism, and prevent identity fraud. Digital identity solutions provide a reliable means of authenticating individuals, verifying their eligibility for government services, and enhancing overall security measures.

Moreover, within governmental systems secure digital identities have become increasingly crucial due to rising number cyber attacks resulting from increased prevalence of cyber threats and data breaches. Governments are prime targets for cyber attacks, even more so when it comes to compromising citizen information hence leading into severe damages. Digital identity solutions help fortify government databases and systems such that only authorized staffs gain access to sensitive information thereby reducing cases identify theft along with fraudulent behaviours.

Additionally, the adoption of emerging technologies such as blockchain is impacting the digital identity landscape in the government sector. Blockchain offers transparent management framework for digital identifications thereby curbing manipulations done on vital records electronically carried out. By exploring opportunities based on blockchain, governments aim to pioneer the field of digital identity for making fraud-proof and more flexible verification systems.

Similarly, with respect to digital identification in public sector, regulatory environment plays a significant role. Governments are coming up with legislation and guidelines that ensure responsible and ethical usage of digital identification technologies. To foster public trust as well as integrity of national government run initiatives towards ensuring safe authentication methods, it is necessary that data protection laws governing privacy be adhered to.

Leave a Comment