Digital Identity in Government Sector Market Summary

As per Market Research Future analysis, the Digital Identity in Government Sector Market was estimated at 2.603 USD Billion in 2024. The Digital Identity industry is projected to grow from 3.08 USD Billion in 2025 to 16.56 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 18.32% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Digital Identity in Government Sector Market is experiencing robust growth driven by technological advancements and increasing demand for secure services.

- The integration of biometric technologies is becoming a prevalent trend in enhancing identity verification processes.

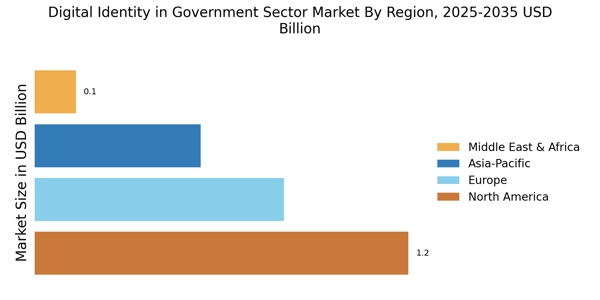

- Interoperability initiatives are gaining traction, particularly in North America, to streamline digital identity systems across various government agencies.

- A user-centric design focus is emerging, especially in the Asia-Pacific region, to improve citizen engagement and satisfaction with digital services.

- Rising demand for secure digital services and regulatory compliance are key drivers propelling the growth of solutions in the market.

Market Size & Forecast

| 2024 Market Size | 2.603 (USD Billion) |

| 2035 Market Size | 16.56 (USD Billion) |

| CAGR (2025 - 2035) | 18.32% |

Major Players

IDEMIA (FR), Thales (FR), Gemalto (NL), Accenture (IE), Microsoft (US), IBM (US), Oracle (US), Veridos (DE), NEC (JP)