Growing Emphasis on Digital Inclusion

The digital identity-in-government-sector market in Europe is increasingly focused on promoting digital inclusion. Governments recognize the importance of ensuring that all citizens, including marginalized groups, have access to digital identity solutions. This emphasis on inclusivity is driven by the need to bridge the digital divide and ensure equitable access to government services. Initiatives aimed at providing digital literacy training and affordable access to technology are gaining traction. As a result, investments in digital identity solutions that cater to diverse populations are expected to rise, potentially reaching €3 billion by 2025, thereby enhancing overall citizen engagement and participation in the digital economy.

Rising Demand for Secure Digital Services

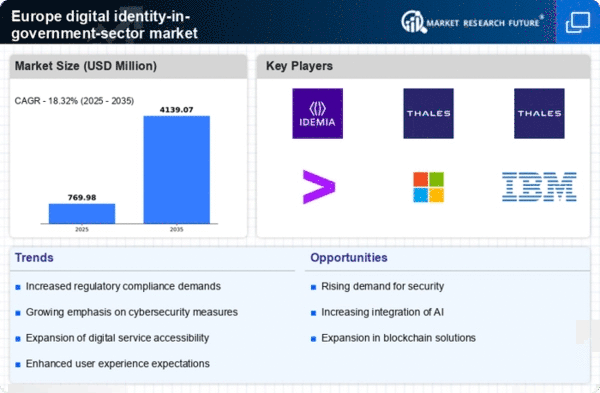

The digital identity-in-government-sector market in Europe is experiencing a notable surge in demand for secure digital services. Citizens increasingly expect seamless access to government services while ensuring their personal data remains protected. This trend is driven by heightened awareness of data privacy issues and the need for robust security measures. According to recent studies, approximately 70% of European citizens express concerns about data breaches, prompting governments to invest in advanced digital identity solutions. As a result, the market is projected to grow at a CAGR of 15% over the next five years, reflecting the urgency for secure digital identity frameworks that can enhance public trust and facilitate efficient service delivery.

Regulatory Support for Digital Identity Initiatives

The digital identity-in-government-sector market in Europe benefits significantly from regulatory support aimed at enhancing digital identity frameworks. The European Union has introduced various directives and regulations, such as the eIDAS Regulation, which establishes a legal framework for electronic identification and trust services. This regulatory environment encourages governments to adopt standardized digital identity solutions, fostering interoperability and user trust. As a result, public sector investments in digital identity technologies are expected to reach €5 billion by 2026, indicating a strong commitment to modernizing identity verification processes and improving citizen engagement through secure digital channels.

Technological Advancements in Identity Verification

Technological advancements play a crucial role in shaping the digital identity-in-government-sector market in Europe. Innovations such as artificial intelligence, machine learning, and blockchain technology are revolutionizing identity verification processes. These technologies enhance the accuracy and efficiency of identity checks, reducing the risk of fraud and identity theft. For instance, AI-driven solutions can analyze vast amounts of data to verify identities in real-time, streamlining government services. The market for these advanced identity verification technologies is anticipated to grow by 20% annually, reflecting the increasing reliance on sophisticated solutions to meet the evolving demands of citizens and government agencies.

Increased Collaboration Between Public and Private Sectors

The digital identity-in-government-sector market in Europe is witnessing increased collaboration between public and private sectors. Governments are partnering with technology companies to leverage their expertise in developing and implementing digital identity solutions. This collaboration aims to enhance the efficiency and effectiveness of identity verification processes while ensuring compliance with regulatory standards. Such partnerships are likely to lead to innovative solutions that address the unique challenges faced by government agencies. The market is projected to see a 25% increase in collaborative projects over the next few years, indicating a shift towards a more integrated approach to digital identity management.