Market Analysis

In-depth Analysis of Digital Identity in Healthcare Market Industry Landscape

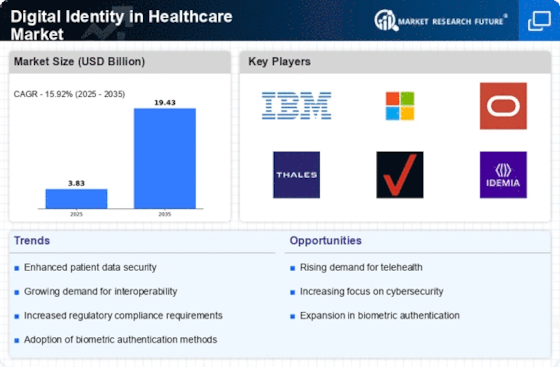

Information security and protection awareness is driving this trend. Healthcare providers are implementing advanced Digital Identity solutions to provide secure access, preserve patient data, and comply with HIPAA as health records and clinical data are digitized. Protecting patient data from unauthorised access and digital threats drives the use of robust Digital Identity solutions in healthcare.

Telehealth and remote healthcare administrations are another major factor affecting the Digital Identity in Healthcare industry. The rise in virtual healthcare talks and remote monitoring necessitates strong identity verification to verify patients and healthcare providers. Digital Identity arrangements ensure safe patient onboarding, validation, and access to virtual healthcare administrations, making telehealth arrangements viable and widely accepted.

Digital Identity arrangements are driven by interoperability and the need for a tolerant identity across healthcare frameworks. Healthcare partners include emergency clinics, clinics, insurance providers, and medication companies. Interoperability and patient identity across various medications are essential for integrated, patient-driven treatment. Digital identity arrangements standardize patient identification, enabling uniform information exchange, decreasing errors, and improving healthcare efficiency.

The global shift toward EHRs and HIEs also drives the Digital Identity in Healthcare industry. Secure and standardised identity check procedures are needed to transition from paper to electronic records. Digital identity systems help ensure that only authorized academics access patient records, reducing the risk of data breaches and unauthorised release of sensitive health data. Integrating Digital Identity setups improves EHR security and promotes digital health information frameworks.

The rise of patient-driven healthcare models is affecting healthcare digital identity arrangements. Patient-driven care requires giving patients control over their health data and letting them access and share it safely. Digital Identity arrangements encourage patient commitment by offering secure patient entryways to manage health information, schedule appointments, and communicate with healthcare providers.

The rise of healthcare extortion and identity theft drives Digital Identity arrangements. Healthcare groups face serious financial and reputational risks from misinformation. Digital identity systems with biometric verification and multifaceted validation improve patient recognizable proof accuracy and security, reducing the risk of insurance misrepresentation, fraud, and unapproved clinical benefit access.

Leave a Comment