Increased Cybersecurity Threats

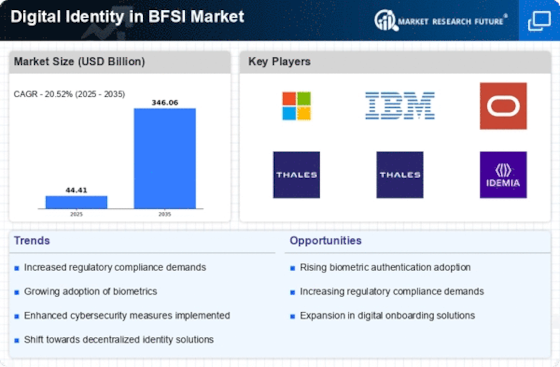

The Digital Identity in BFSI Market is experiencing heightened demand due to the escalating threats posed by cybercriminals. Financial institutions are increasingly targeted, with data breaches and identity theft incidents rising significantly. According to recent statistics, the financial sector has seen a 30% increase in cyberattacks over the past year. This alarming trend compels banks and financial service providers to invest in robust digital identity solutions to safeguard customer data and maintain trust. Enhanced security measures, such as multi-factor authentication and advanced encryption techniques, are becoming essential components of digital identity frameworks. As a result, the market for digital identity solutions is projected to grow at a compound annual growth rate (CAGR) of 15% over the next five years, reflecting the urgent need for improved cybersecurity in the BFSI sector.

Rise of Mobile Banking and Digital Wallets

The proliferation of mobile banking and digital wallets is a key driver in the Digital Identity in BFSI Market. As consumers increasingly rely on mobile devices for financial transactions, the need for secure and efficient digital identity solutions has surged. Mobile banking applications require robust identity verification mechanisms to protect users from fraud and unauthorized access. Data indicates that mobile banking users have grown by 40% in the last two years, highlighting the urgency for financial institutions to implement effective digital identity strategies. This trend is prompting banks to invest in biometric authentication and other advanced identity verification technologies to enhance security and user experience. The growth of mobile banking is expected to propel the digital identity market, with forecasts suggesting a potential market size of USD 30 billion by 2029.

Growing Demand for Seamless Customer Experience

In the Digital Identity in BFSI Market, there is a pronounced shift towards enhancing customer experience through seamless digital interactions. Customers increasingly expect quick and efficient services, which necessitates the implementation of streamlined identity verification processes. Financial institutions are adopting digital identity solutions that facilitate instant onboarding and reduce friction during transactions. This trend is supported by data indicating that 70% of consumers are likely to abandon a transaction if the identity verification process is cumbersome. Consequently, the BFSI sector is investing heavily in technologies such as biometric authentication and AI-driven identity verification to meet these expectations. The focus on customer-centric solutions is anticipated to drive the digital identity market, with projections indicating a potential market size of USD 20 billion by 2027.

Regulatory Pressures and Compliance Requirements

The Digital Identity in BFSI Market is significantly influenced by the increasing regulatory pressures imposed on financial institutions. Governments and regulatory bodies are mandating stricter compliance measures to combat money laundering, fraud, and identity theft. For instance, the implementation of Know Your Customer (KYC) regulations requires banks to verify the identities of their clients rigorously. This regulatory landscape compels financial institutions to adopt advanced digital identity solutions that ensure compliance while enhancing operational efficiency. The market is responding to these pressures, with a projected growth rate of 12% annually as institutions seek to align their identity verification processes with evolving regulations. As compliance becomes a critical factor, the demand for sophisticated digital identity technologies is expected to rise, shaping the future of the BFSI sector.

Technological Advancements in Identity Verification

Technological innovations are driving transformation within the Digital Identity in BFSI Market. The advent of artificial intelligence, machine learning, and blockchain technology is revolutionizing identity verification processes. These advancements enable financial institutions to enhance the accuracy and speed of identity checks, thereby reducing the risk of fraud. For example, AI algorithms can analyze vast amounts of data to detect anomalies and verify identities in real-time. The integration of blockchain technology further enhances security by providing a decentralized and tamper-proof record of identity transactions. As these technologies mature, the digital identity market is expected to expand, with estimates suggesting a market value of USD 25 billion by 2028. The continuous evolution of technology will likely play a pivotal role in shaping the future landscape of digital identity solutions in the BFSI sector.

.png)