Rising Demand in Agriculture

The Global Dimethyl Disulphide Market (DMDS) Market Industry is experiencing a surge in demand driven by its application as a soil fumigant and pesticide. Farmers are increasingly adopting DMDS for its effectiveness in controlling nematodes and other soil-borne pests, which enhances crop yields. As agricultural practices evolve, the need for effective pest management solutions becomes paramount. This trend is expected to contribute significantly to the market's growth, with projections indicating that the market could reach 450 USD Million in 2024. The agricultural sector's reliance on DMDS is likely to bolster its position within the global market.

Industrial Applications and Growth

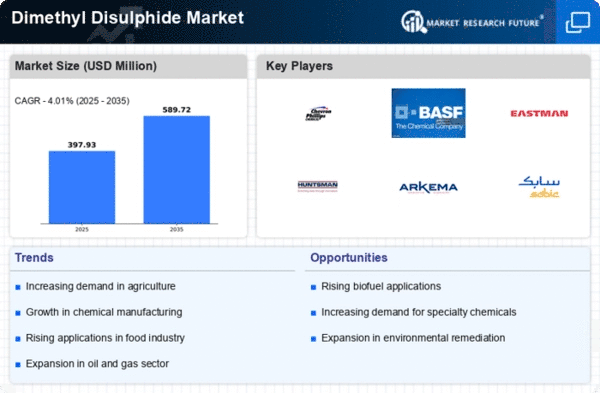

The Global Dimethyl Disulphide Market (DMDS) Market Industry is witnessing robust growth due to its diverse industrial applications, particularly in the petrochemical sector. DMDS serves as a crucial intermediate in the production of various chemicals, including sulfur compounds and lubricants. As industries continue to expand and innovate, the demand for DMDS is projected to increase significantly. The market is anticipated to grow at a compound annual growth rate of 9.33% from 2025 to 2035, potentially reaching 1200 USD Million by 2035. This growth trajectory underscores the importance of DMDS in supporting industrial processes and chemical manufacturing.

Emerging Markets and Global Expansion

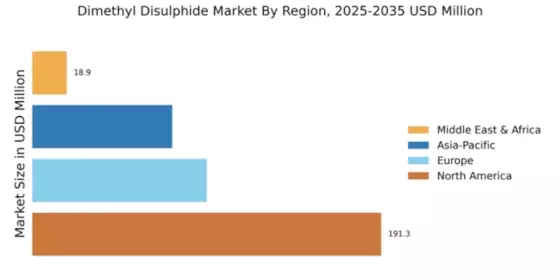

The Global Dimethyl Disulphide Market (DMDS) Market Industry is expanding into emerging markets, where industrialization and agricultural development are accelerating. Regions such as Asia-Pacific and Latin America are witnessing increased investments in agriculture and chemical manufacturing, creating new opportunities for DMDS. As these markets develop, the demand for effective pest control and chemical intermediates is likely to rise. This expansion into new geographical areas may contribute to the overall growth of the market, with projections indicating a significant increase in market size over the coming years. The global reach of DMDS is expected to enhance its market presence.

Environmental Regulations Favoring DMDS

The Global Dimethyl Disulphide Market (DMDS) Market Industry is positively influenced by stringent environmental regulations that promote the use of less harmful chemicals. DMDS is recognized for its relatively low toxicity compared to traditional fumigants, making it a preferred choice for environmentally conscious agricultural practices. Governments worldwide are increasingly advocating for sustainable farming solutions, which may lead to a shift towards DMDS as a viable alternative. This regulatory support is likely to enhance the market's growth prospects, as more stakeholders seek to comply with environmental standards while maintaining agricultural productivity.

Technological Advancements in Production

The Global Dimethyl Disulphide Market (DMDS) Market Industry benefits from ongoing technological advancements in production processes. Innovations in synthesis methods and purification techniques are enhancing the efficiency and cost-effectiveness of DMDS production. As manufacturers adopt these new technologies, the supply of DMDS is expected to increase, meeting the growing demand from various sectors. This improvement in production capabilities may lead to a more competitive market landscape, potentially driving down prices and making DMDS more accessible to end-users. Consequently, the market is poised for growth as production becomes more streamlined and efficient.