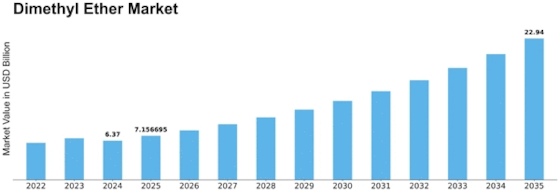

Dimethyl Ether Size

Dimethyl Ether Market Growth Projections and Opportunities

The DME (Dimethyl ether) industry is experiencing substantial growth driven by a confluence of factors such as expanding applications, technological advancements, and escalating demand, particularly in energy-deficient countries. Across the Asia-Pacific region, excluding Japan, there is a significant emphasis on utilizing DME primarily for blending with LPG (Liquefied Petroleum Gas). DME finds widespread application in LPG blending, serving as an aerosol propellant, and functioning as a substitute for diesel. Notably, coal emerges as the primary feedstock for global DME production. Countries endowed with abundant natural gas resources are directing investments toward infrastructure development to position natural gas as an alternative fuel source. As of 2012, the global DME market was estimated at approximately 2,998.2 KT (kilotons). In Scenario I, this volume is anticipated to reach 6,500.6 KT by 2018 and further escalate to 11,390.8 KT by 2023. This growth is projected at a Compound Annual Growth Rate (CAGR) of 14.0% from 2013 to 2018 and 12.9% from 2013 to 2023. The surge in demand, especially for blending with LPG in countries like China, Korea, and Indonesia, is expected to propel the DME market forward. Indonesia, in particular, is anticipated to exhibit the highest CAGR of over 100.0% during the forecast period. The demand for DME as a diesel substitute is anticipated to witness significant growth in Japan and Sweden. Japan's growth is expected to accelerate post-2018, while Sweden is projected to experience notable growth before 2018.

In Scenario II, efforts to develop the DME market are expected to intensify across various countries, accompanied by sustained high operating rates. Additionally, considerations include the capacity of India and expansion plans for the Egypt plant. With these optimistic assumptions, it is envisaged that DME consumption volume may reach 8,817.0 KT by 2018, growing at a CAGR of 21.1% from 2013 to 2018, and further escalate to 16,316.2 KT by 2023, growing at a CAGR of 17.1% from 2013 to 2023.

The driving forces behind the industry's growth include an increasing dependence on LPG imports, the presence of rich coal deposits in the Asia-Pacific region, and a growing focus on environmental concerns. However, a significant constraint to market growth is the need for infrastructure alterations. Additionally, the industry faces challenges related to low capacity utilization. To address the demand generated, industry players are adopting strategic approaches such as capacity expansions and collaborations with key stakeholders within the value chain, particularly in key developing countries.

Leave a Comment