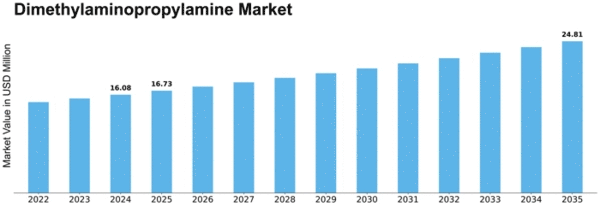

Dimethylaminopropylamine Size

Dimethylaminopropylamine Market Growth Projections and Opportunities

The Dimethylaminopropylamine (DMAPA) Market experiences influences from a variety of factors that collectively shape its growth, demand patterns, and overall competitiveness. These factors encompass industry-specific considerations and broader economic and environmental influences. Here's a succinct breakdown of key market factors defining the landscape of the Dimethylaminopropylamine Market:

Polyurethane Industry Growth:

DMAPA is a key building block in the production of polyurethane, a versatile polymer used in coatings, adhesives, and sealants.

The expansion of the polyurethane industry, driven by applications in construction, automotive, and furniture, significantly influences the demand for DMAPA.

Adhesives and Sealants Manufacturing:

DMAPA is utilized in the production of adhesives and sealants, where its amine functionality contributes to the cross-linking and bonding properties of these formulations.

The construction, packaging, and automotive sectors contribute to the demand for adhesives and sealants, impacting the DMAPA market.

Surfactant and Emulsifier Applications:

DMAPA finds use as a surfactant and emulsifier in the production of personal care and household products, enhancing the stability and performance of formulations.

The cosmetics, detergents, and cleaning industries drive the demand for DMAPA as a versatile ingredient in surfactant applications.

Textile and Paper Industry Usage:

DMAPA serves as a wetting agent and softener in the textile industry, contributing to the finishing processes of fabrics.

Its application in the paper industry as a sizing agent and retention aid influences the demand for DMAPA in the production of specialty papers.

Growth in Water Treatment Applications:

DMAPA is employed in water treatment formulations as a corrosion inhibitor and antiscalant, contributing to the efficiency of water treatment processes.

The increasing focus on water quality and environmental regulations drive the demand for DMAPA in the water treatment sector.

Agrochemical Industry Utilization:

DMAPA is used in the production of certain agrochemicals, serving as an intermediate in the synthesis of herbicides and pesticides.

The agriculture sector's demand for effective crop protection solutions influences the market for DMAPA in agrochemical applications.

Asia-Pacific as a Key Consumption Region:

The Asia-Pacific region, particularly China, plays a significant role as a major consumer and producer of DMAPA.

The region's robust industrial activities and manufacturing sectors contribute to the overall dynamics of the DMAPA market.

Technological Innovations in Formulations:

Ongoing research and development efforts focus on innovative formulations and applications for DMAPA.

Technological advancements contribute to the development of enhanced products and broaden the scope of DMAPA applications in various industries.

Environmental and Regulatory Compliance:

Stringent environmental regulations impact the production and use of DMAPA, particularly in industries such as personal care and water treatment.

Adherence to environmental standards and regulatory requirements is essential for market players to ensure compliance and market acceptance.

Fluctuations in Raw Material Prices:

The DMAPA market is susceptible to fluctuations in the prices of raw materials, such as propylene oxide and dimethylamine.

Price volatility poses challenges for manufacturers in maintaining stable pricing strategies and profit margins.

Global Economic Trends:

Economic factors, including GDP growth, industrial output, and infrastructure investments, impact the overall demand for DMAPA in key markets.

Economic trends influence investment decisions and consumption patterns in industries utilizing DMAPA, shaping the trajectory of the market.

Competitive Landscape and Market Consolidation:

The DMAPA market witnesses competitive dynamics with key players engaging in mergers, acquisitions, and strategic alliances.

Market consolidation efforts contribute to the emergence of dominant players with a diverse product portfolio and global market presence.

Leave a Comment