Research Methodology on Directed Energy Weapons Market

Introduction

The recent technology trend of directed energy weapons has been increasing with various militaries and security agencies across the world investing in these. It has enabled dual-use products for civilian and military applications. The rising trend of adoption of directed energy weapons is driving the global directed energy weapons market growth in emerging economies.

The report market focuses on the global directed energy weapons market and the attractive opportunity this market presents. The growth potential and influencing factors have been discussed thoroughly, along with the study of the changing market dynamics, market size, current trends, and trends associated with the target market.

Objective

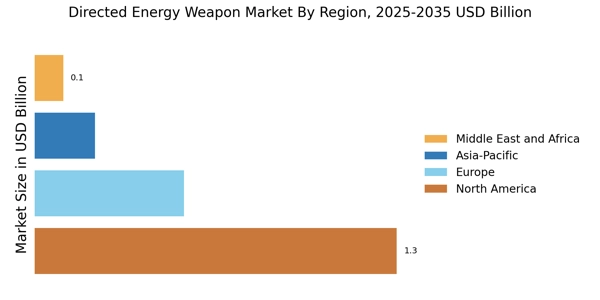

- To understand how the market size for the directed energy weapons industry is expected to evolve during the forecast period 2023 to 2030.

- To analyze the key drivers, opportunities, and market dynamics

- To define the competitive landscape and identify the key players in this market

- To understand the current trajectory of the industry and determine the preferred market strategies for players in the near future

- To predict the future trend and expected market outlook through analysis of the macroeconomic and geographic factors

Research Methodology

The research study uses a two-pronged approach to compile and analyze the data from multiple sources such as primary and secondary research. Primary research involves interactions with market stakeholders (industry experts, vendors, end-users, etc.) to gather relevant data on the growth prospects of the directed energy weapons industry. Secondary research involves gathering information by studying published reports, press releases, company websites, and government portal websites. Both the sources of research are blended to present an unbiased report on the market.

The report on the directed energy weapons market has been compiled using techniques such as bottom-up and top-down. The bottom-up approach entails studying the individual market segments and deriving a value for the overall market from these estimated individual segments’ values. The top-down approach entails estimating the overall market size by directly studying the market drivers and developments. The overall process is a combination of both secondary and primary research methods.

Various statistical techniques, including trend analysis, demand-supply triangulation, time-series analysis, factor analysis, and others, have been used to conduct market analysis to develop market estimates and forecasts. The report also includes details on the sales channels of products used in the directed energy weapons market.

Secondary research

Secondary research was used to gain an understanding of the directed energy weapons market. It includes an in-depth analysis of the market dynamics, trends, and competitive landscape. Secondary research is also used to gather information from various companies and organizations such as industry experts, vendors, and technology providers.

The secondary sources of data include business journals, paid and free databases, industry-specific reports, SEC filings, and research papers.

Primary Research

The primary research process for the report on the directed energy weapons market consists of a series of in-depth interviews with key stakeholders in the industry. End-users, technology providers, and industry experts in the field of directed energy weapons were contacted for primary research.

The primary research process involved in-depth interviews with individuals such as CEOs, CTOs, technology providers, industry experts, and marketing executives to understand the market dynamics, trends, and competitive landscape of the directed energy weapons market.