Market Share

Disinfectant Chemicals Market Share Analysis

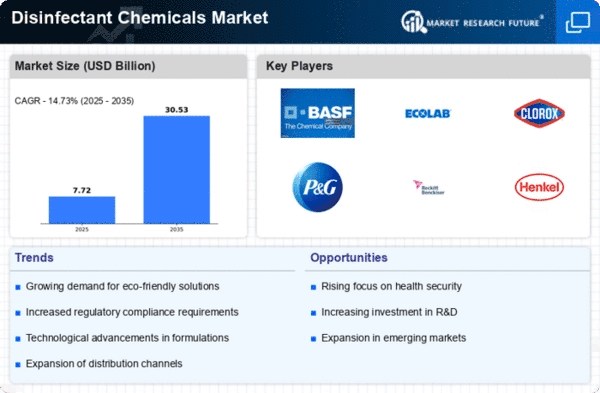

Dissinfection chemicals nowadays are more preferred by dense populations in the whole world than in the past years. These cases are rare because the NK cells have the capacity to regulate, neutralize or eradicate harmful bacteria from inanimate objects or surfaces. Hence, the demand for gloves, gowns, aprons, masks, and a variety of equipment has been significantly raised on the side of clinics, hospitals, research and diagnostic laboratories. Further, after covid 19 there was an increase in demand for disinfectant. This figure shows that the companies servicing the global disinfectant chemicals market have a vast growth scope in upcoming years. Moreover, the various bacteria, viruses and parasites like norovirus, salmonella, cholera etc spread through unsanitary water and food which are the main reasons for food and waterborne illnesses.

The disinfectant chemicals Market, a subdivision of a cleaning and hygiene industry, which possesses a range of positioning strategies in the marketplace to tackle this competitive environment. The strategy aims at providing unique products through each innovation. Companies inside the disinfectant chemicals market are wholeheartedly committed to investing millions of dollars in R&D in order to create next-gen formulations that can have wide-spectrum effectiveness, fast-acting properties, and inter-surface compatibility. Through latest product solutions, they situate themselves in these areas of markets which is about healthcare, hospitality, and household cleaning, and where disinfection is of key importance from the public health and safety point of view.

Cost leadership, however, is another key success strategy within the disinfectant chemicals market. A few may concentrate on maximum efficiency of the processes involved in the production of raw materials, cost effective sourcing of the same and achieving economies of scale, which will help them provide disinfectants at competitive prices. This strategy is very successful in industries where the price factor is heavily influential in the purchasing decisions, like commercial cleaning works and institutional buyers. Through provision of reliable, cheap and yet very efficient disinfectants, companies can accumulate a significant market share and thus determined as preferred suppliers in the low-cost markets

Collaboration along with the strategic partnerships perform a significant role when it comes to setting the market share for the disinfectant chemicals market. Companies develop partnerships with the key stakeholders who are the healthcare facilities hospitals, cleaning service providers, and government entities alike. Working together helps to straighten the supply chain that in turn results in a constant and steady railway line. With strategic partnerships, companies benefit from entry into new markets and mastery of innovative technologies and the potential of new customers. Companies tap into these benefits and achieve increased market share and brand recognition.

Leave a Comment