Regulatory Support

Government regulations play a pivotal role in shaping the Global Disinfectant Chemicals Market Industry. Regulatory bodies are increasingly mandating the use of effective disinfectants in various sectors, including healthcare, food processing, and public spaces. These regulations aim to enhance public health and safety standards, thereby driving demand for compliant disinfectant products. For example, the Environmental Protection Agency (EPA) in the United States has established guidelines for disinfectant efficacy, which encourages manufacturers to innovate and improve their offerings. This regulatory support is expected to contribute to the market's expansion, as businesses seek to adhere to these standards.

Rising Health Awareness

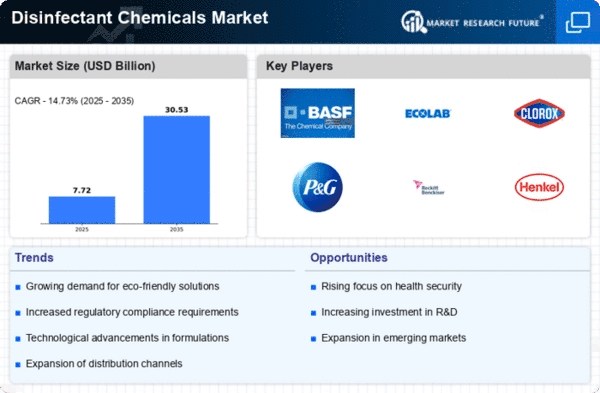

The Global Disinfectant Chemicals Market Industry is experiencing growth driven by increasing health awareness among consumers and businesses. As individuals become more conscious of hygiene practices, the demand for disinfectant products rises. This trend is particularly evident in healthcare settings, where stringent sanitation protocols are essential. For instance, hospitals and clinics are investing in advanced disinfectant solutions to ensure patient safety. The market is projected to reach 3.58 USD Billion in 2024, reflecting a significant shift in consumer behavior towards cleanliness and safety. This heightened awareness is likely to sustain the industry's growth trajectory in the coming years.

Technological Advancements

Technological innovations are significantly influencing the Global Disinfectant Chemicals Market Industry. The development of novel disinfectant formulations and delivery systems enhances the efficacy and convenience of these products. For instance, advancements in nanotechnology have led to the creation of disinfectants that provide longer-lasting protection against pathogens. Additionally, the integration of smart technologies, such as automated dispensing systems, is streamlining the application of disinfectants in various settings. These advancements not only improve product performance but also cater to the evolving needs of consumers, thereby propelling market growth. As the industry adapts to these technological changes, it is likely to witness sustained demand.

Expanding End-User Industries

The Global Disinfectant Chemicals Market Industry is bolstered by the expansion of end-user industries, including healthcare, hospitality, and food service. As these sectors grow, so does the need for effective disinfectant solutions to maintain hygiene standards. For example, the hospitality industry is increasingly adopting disinfectants to ensure guest safety and satisfaction, particularly in high-touch areas. The food service sector is also prioritizing sanitation to comply with health regulations and consumer expectations. This diversification across various industries is expected to drive the market's growth, with projections indicating a rise to 8.0 USD Billion by 2035, reflecting the increasing reliance on disinfectant chemicals.

Consumer Preference for Eco-Friendly Products

There is a noticeable shift in consumer preference towards eco-friendly disinfectant products within the Global Disinfectant Chemicals Market Industry. As environmental concerns gain prominence, consumers are seeking sustainable alternatives that minimize ecological impact. This trend is prompting manufacturers to develop biodegradable and non-toxic disinfectants that align with consumer values. For instance, products derived from natural ingredients are gaining traction in both residential and commercial markets. This growing demand for environmentally responsible options is likely to influence product development strategies, encouraging companies to innovate and expand their eco-friendly offerings, thereby contributing to the overall market growth.