Market Trends

Key Emerging Trends in the Disposable Surgical Devices Market

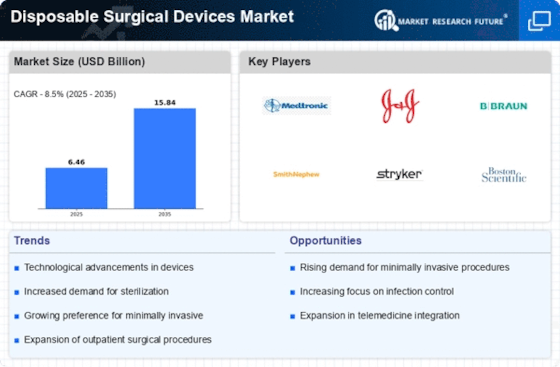

The market trends of disposable surgical devices have witnessed significant evolution, driven by a combination of technological advancements, increasing surgical procedures, and a growing emphasis on infection control. One prominent trend in the disposable surgical devices market is the surge in demand for minimally invasive procedures. As patients and healthcare professionals seek alternatives to traditional surgeries, the need for disposable surgical devices, such as trocars, catheters, and scalpel blades, designed specifically for minimally invasive techniques, has risen. This trend reflects a shift towards less invasive and more patient-friendly surgical interventions.

Another key factor shaping the market is the increasing awareness and importance of infection control measures in healthcare settings. Disposable surgical devices play a crucial role in reducing the risk of healthcare-associated infections. The use of single-use devices eliminates the need for reprocessing, minimizing the chances of contamination and ensuring a higher level of sterility. With a growing focus on patient safety and infection prevention, healthcare facilities are increasingly adopting disposable surgical devices, influencing market dynamics.

The rise of ambulatory surgical centers (ASCs) is also contributing to the growth of the disposable surgical devices market. ASCs offer cost-effective and convenient alternatives to traditional hospital-based surgeries. Disposable devices align well with the operational model of ASCs, eliminating the need for extensive sterilization infrastructure and reducing the risk of cross-contamination. As the popularity of ASCs continues to grow, the demand for disposable surgical devices is expected to increase, reflecting a noteworthy market trend.

Advancements in material technology have led to the development of innovative and more sustainable disposable surgical devices. Manufacturers are exploring eco-friendly materials, such as bio-based polymers, to address environmental concerns associated with medical waste. The introduction of disposable devices with reduced environmental impact resonates with the global push towards sustainability. This trend not only addresses environmental considerations but also caters to the preferences of healthcare providers and organizations seeking greener alternatives in their practices.

Market trends in disposable surgical devices are also influenced by the growing trend of home healthcare. As more medical procedures shift from hospitals to home settings, there is an increased demand for user-friendly and disposable devices. Disposable surgical devices designed for home use provide patients with a convenient and safe option for managing their healthcare needs. This trend aligns with the broader movement towards patient-centric care and the empowerment of individuals in managing their health.

Global events, such as the COVID-19 pandemic, have further accelerated the adoption of disposable surgical devices. The emphasis on infection prevention and control during the pandemic highlighted the importance of using single-use devices to minimize the risk of transmission. Disposable surgical masks, gloves, and other protective gear became critical in healthcare settings and beyond, influencing market dynamics and fostering a greater acceptance of disposable medical products.

Cost-effectiveness remains a significant driver of market trends in the disposable surgical devices sector. While there is an upfront cost associated with using disposable devices, the long-term savings in terms of reduced sterilization expenses and the prevention of healthcare-associated infections make them economically attractive. Healthcare facilities are increasingly recognizing the financial benefits of disposable surgical devices, contributing to their widespread adoption.

Leave a Comment