Technological Innovations

Technological innovations play a crucial role in shaping the Disposable Surgical Devices Market. Advances in materials science and manufacturing processes have led to the development of more effective and reliable disposable devices. Innovations such as biocompatible materials and enhanced sterilization techniques are becoming increasingly prevalent. These advancements not only improve the performance of surgical devices but also contribute to better patient outcomes. The market is witnessing a shift towards smart disposable devices that integrate technology for enhanced functionality. This trend is expected to propel the Disposable Surgical Devices Market forward, as healthcare providers seek to leverage technology to improve surgical efficiency and safety.

Rising Surgical Procedures

The increasing number of surgical procedures worldwide is a primary driver for the Disposable Surgical Devices Market. As healthcare systems evolve and expand, the demand for surgical interventions rises. According to recent data, the number of surgical procedures is projected to reach over 300 million annually by 2025. This surge necessitates the use of disposable surgical devices, which offer convenience and efficiency. Hospitals and surgical centers are increasingly adopting these devices to enhance patient safety and streamline operations. The Disposable Surgical Devices Market is thus poised for growth, as healthcare providers seek to meet the rising demand for surgical services while ensuring high standards of hygiene and safety.

Regulatory Support and Standards

Regulatory support and the establishment of stringent standards are vital drivers for the Disposable Surgical Devices Market. Regulatory bodies are increasingly focusing on ensuring the safety and efficacy of medical devices, which has led to the implementation of comprehensive guidelines. These regulations encourage manufacturers to adhere to high-quality standards, fostering innovation and competition within the market. As a result, the Disposable Surgical Devices Market is likely to benefit from enhanced consumer trust and increased adoption of disposable devices in surgical settings. The emphasis on compliance with regulatory standards is expected to drive market growth as healthcare providers prioritize safety and quality.

Growing Awareness of Infection Control

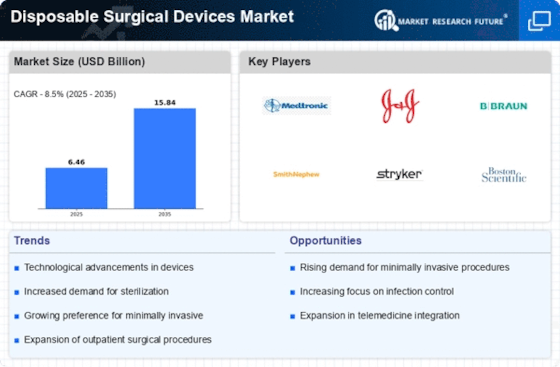

The heightened awareness surrounding infection control significantly influences the Disposable Surgical Devices Market. Healthcare professionals and institutions are increasingly prioritizing the use of disposable devices to minimize the risk of hospital-acquired infections. The World Health Organization has emphasized the importance of infection prevention, leading to a shift in surgical practices. As a result, the market for disposable surgical devices is expected to expand, with a projected growth rate of approximately 7% annually. This trend reflects a broader commitment to patient safety and quality care, driving healthcare facilities to invest in disposable solutions that reduce cross-contamination risks.

Shift Towards Minimally Invasive Surgeries

The shift towards minimally invasive surgeries is a significant factor influencing the Disposable Surgical Devices Market. These procedures, which often require specialized disposable devices, are gaining popularity due to their associated benefits, such as reduced recovery times and lower risk of complications. As surgical techniques evolve, the demand for disposable surgical devices that cater to these procedures is expected to rise. The market is projected to grow as healthcare providers increasingly adopt minimally invasive approaches, which necessitate the use of high-quality disposable devices. This trend reflects a broader movement towards enhancing patient care and optimizing surgical outcomes.