Regulatory Support and Standardization

Regulatory bodies are increasingly supporting the adoption of robotic surgical systems, which is positively impacting the Robotic Surgical Systems Devices Market. The establishment of clear guidelines and standards for the use of robotic technologies in surgery is fostering confidence among healthcare providers. Regulatory approvals for new robotic systems are being expedited, allowing for quicker market entry of innovative devices. This regulatory support is crucial, as it not only ensures patient safety but also encourages manufacturers to invest in research and development. As a result, the market is likely to see a proliferation of advanced robotic systems that meet stringent regulatory requirements, further driving growth in the industry.

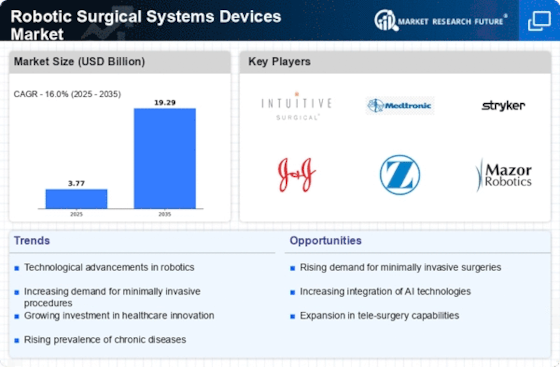

Technological Advancements in Robotics

The Robotic Surgical Systems Devices Market is experiencing a surge in technological advancements that enhance surgical precision and efficiency. Innovations such as improved robotic arms, advanced imaging systems, and artificial intelligence integration are transforming surgical procedures. For instance, the introduction of haptic feedback technology allows surgeons to feel the tissue they are operating on, thereby increasing accuracy. According to recent data, the market for robotic surgical systems is projected to reach USD 20 billion by 2026, driven by these technological innovations. Furthermore, the development of smaller, more versatile robotic systems is likely to expand the range of procedures that can be performed robotically, thereby increasing adoption rates across various surgical specialties.

Growing Awareness and Training Programs

The Robotic Surgical Systems Devices Market is witnessing a rise in awareness and training programs aimed at educating healthcare professionals about robotic surgery. As more surgeons become familiar with robotic systems, the adoption rate is expected to increase. Educational initiatives, including workshops and certification programs, are being implemented to ensure that surgeons are well-equipped to utilize these advanced technologies effectively. Data suggests that hospitals with comprehensive training programs report a 30% higher adoption rate of robotic systems compared to those without. This growing emphasis on education is likely to enhance the skill set of surgical teams, thereby promoting the use of robotic surgical systems and contributing to market expansion.

Rising Demand for Minimally Invasive Procedures

The growing preference for minimally invasive surgical techniques is a key driver in the Robotic Surgical Systems Devices Market. Patients increasingly favor procedures that promise reduced recovery times, less postoperative pain, and minimal scarring. As a result, hospitals and surgical centers are investing in robotic systems that facilitate these types of surgeries. Data indicates that minimally invasive surgeries account for over 60% of all surgical procedures in certain regions, highlighting a significant shift in surgical practices. This trend is expected to continue, with robotic systems playing a crucial role in meeting the demand for efficient and patient-friendly surgical options. Consequently, the market for robotic surgical systems is likely to expand as healthcare providers seek to enhance their service offerings.

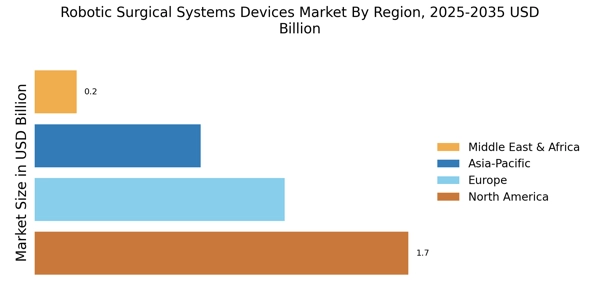

Increased Investment in Healthcare Infrastructure

The Robotic Surgical Systems Devices Market is benefiting from increased investment in healthcare infrastructure, particularly in emerging economies. Governments and private entities are recognizing the importance of advanced surgical technologies in improving healthcare outcomes. For example, investments in hospitals and surgical centers are being directed towards acquiring robotic surgical systems, which are seen as essential for modern surgical practices. Recent reports suggest that healthcare spending in several regions is expected to grow by 5-7% annually, with a significant portion allocated to surgical technologies. This influx of capital is likely to accelerate the adoption of robotic systems, thereby driving market growth and enhancing the overall quality of surgical care.