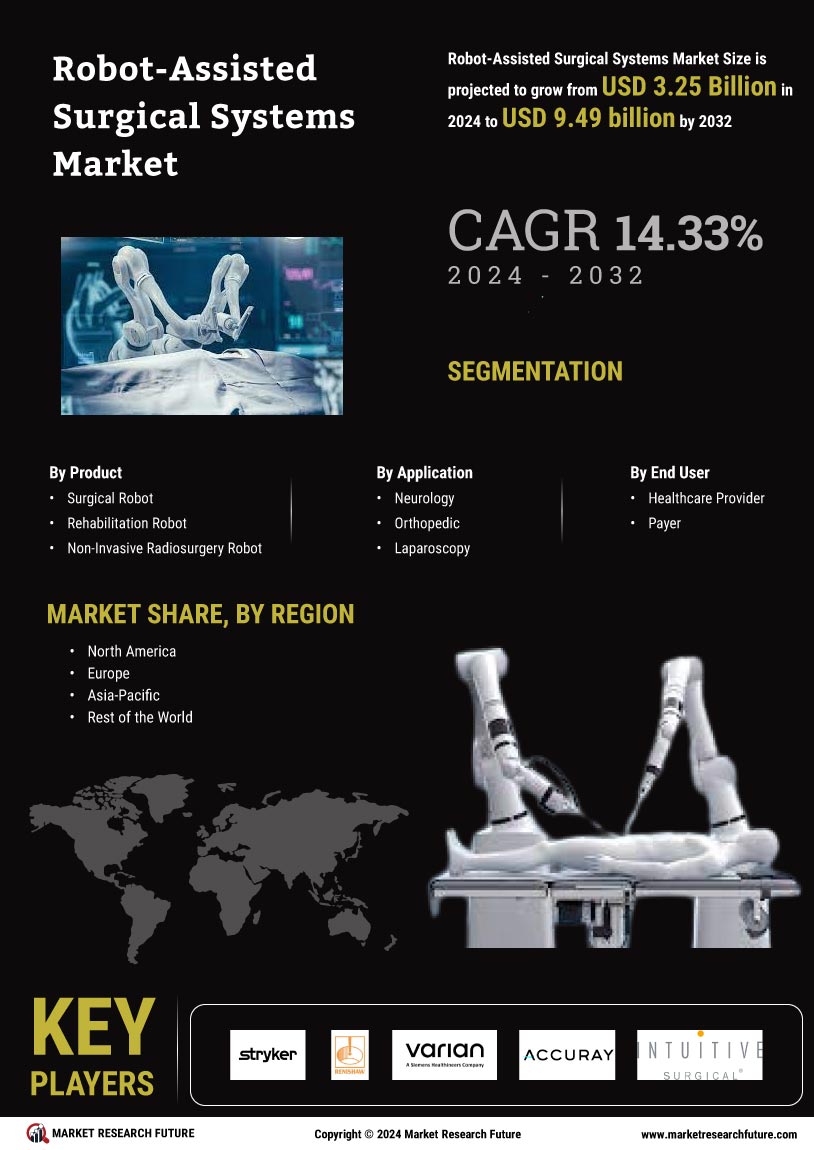

Patient-Centric Healthcare Trends

The Robot-Assisted Surgical Systems Market is influenced by the broader trend of patient-centric healthcare. Patients are becoming more informed and involved in their healthcare decisions, often seeking out the best available treatment options. This shift is leading to a greater demand for advanced surgical techniques that promise better outcomes and enhanced experiences. Robotic surgery, with its precision and minimally invasive nature, aligns well with patient expectations for effective and less traumatic procedures. Data indicates that patient satisfaction rates are higher for robotic-assisted surgeries compared to traditional methods, which is likely to encourage more patients to opt for these procedures. As healthcare providers respond to this demand by integrating robotic systems into their surgical offerings, the market for robotic surgical systems is expected to expand, reflecting the evolving landscape of patient care.

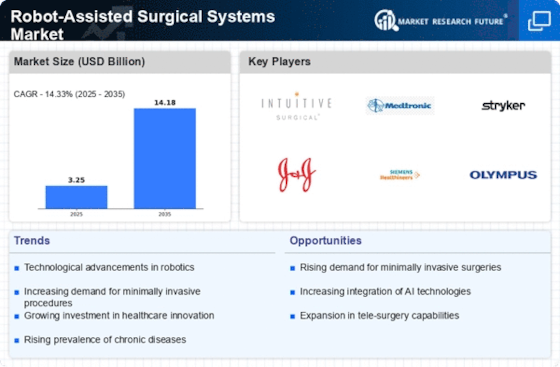

Technological Innovations in Robotics

Technological advancements are a key driver in the Robot-Assisted Surgical Systems Market. Innovations such as enhanced imaging systems, improved robotic arms, and sophisticated software algorithms are transforming surgical practices. These advancements not only improve precision and control during surgeries but also expand the range of procedures that can be performed robotically. For instance, the integration of artificial intelligence and machine learning into robotic systems is enabling surgeons to make more informed decisions in real-time. The market is witnessing a surge in the development of next-generation robotic systems, which are expected to enhance surgical outcomes and reduce complications. As hospitals seek to adopt the latest technologies, the demand for advanced robotic surgical systems is anticipated to rise, further propelling market growth.

Growing Awareness and Acceptance Among Surgeons

The Robot-Assisted Surgical Systems Market is witnessing a growing awareness and acceptance of robotic surgery among surgeons. As more healthcare professionals become familiar with the benefits of robotic systems, there is a shift in surgical practices towards incorporating these technologies. Training programs and workshops are increasingly being offered to educate surgeons on the use of robotic systems, which is fostering confidence in their capabilities. This trend is reflected in the rising number of robotic surgeries performed annually, indicating a shift in surgical paradigms. Furthermore, as surgical outcomes improve and complications decrease, the acceptance of robotic-assisted procedures is likely to grow. This increasing familiarity among surgeons is expected to drive demand for robotic surgical systems, as more practitioners seek to adopt these innovative technologies in their practices.

Rising Demand for Minimally Invasive Procedures

The Robot-Assisted Surgical Systems Market is experiencing a notable increase in demand for minimally invasive surgical procedures. Patients and healthcare providers alike are gravitating towards techniques that promise reduced recovery times, less postoperative pain, and minimal scarring. This trend is supported by data indicating that minimally invasive surgeries can lead to shorter hospital stays and quicker return to normal activities. As a result, hospitals and surgical centers are increasingly investing in robotic systems to enhance their surgical offerings. The market for robotic surgical systems is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is likely driven by the rising patient preference for less invasive options, which aligns with the broader trend of patient-centered care.

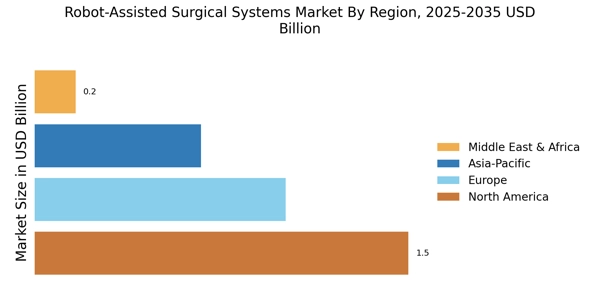

Increased Investment in Healthcare Infrastructure

The Robot-Assisted Surgical Systems Market is benefiting from increased investment in healthcare infrastructure. Governments and private entities are allocating substantial resources to modernize healthcare facilities, which includes the acquisition of advanced surgical technologies. This trend is particularly evident in emerging markets, where healthcare systems are rapidly evolving to meet the needs of growing populations. Data suggests that healthcare spending is projected to rise significantly, with investments in surgical robotics being a focal point. As healthcare facilities upgrade their capabilities, the demand for robotic surgical systems is likely to increase, creating opportunities for manufacturers and suppliers in the market. This influx of capital is expected to enhance the overall quality of surgical care, making robotic systems an integral part of modern surgical practices.