Expansion of 5G Networks

The Distributed Antenna Systems Market is significantly influenced by the ongoing expansion of 5G networks. As telecommunications companies invest heavily in 5G infrastructure, the demand for DAS solutions is expected to rise. 5G technology promises higher data rates, reduced latency, and improved connectivity, which necessitates the deployment of advanced antenna systems to ensure optimal performance. The global 5G infrastructure market is projected to reach USD 47 billion by 2027, highlighting the critical role of DAS in supporting this next-generation technology. This expansion not only enhances user experiences but also drives the need for more sophisticated and widespread antenna systems, positioning DAS as a vital component in the telecommunications landscape.

Growth in Smart Building Projects

The Distributed Antenna Systems Market is poised for growth due to the increasing number of smart building projects. As organizations prioritize energy efficiency and enhanced user experiences, the integration of DAS in smart buildings becomes essential. These systems facilitate seamless wireless communication, which is critical for the operation of smart technologies such as IoT devices and automated systems. The market for smart buildings is expected to reach USD 1 trillion by 2025, indicating a substantial opportunity for DAS providers. Furthermore, the incorporation of DAS in these projects not only enhances connectivity but also supports the overall functionality of smart environments, making it a key driver in the market.

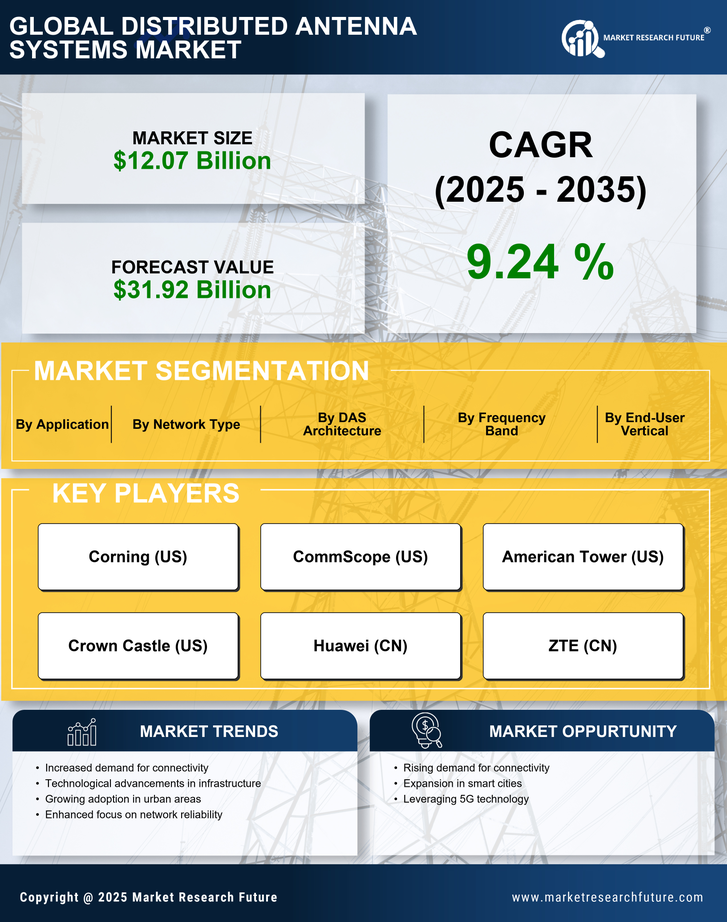

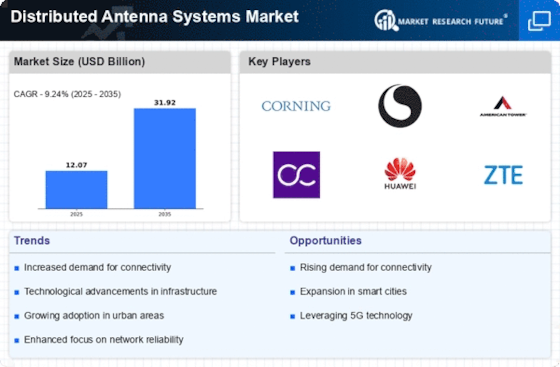

Rising Demand for Enhanced Connectivity

The Distributed Antenna Systems Market is experiencing a notable surge in demand for enhanced connectivity solutions. As urbanization accelerates, the need for reliable wireless communication becomes paramount. This demand is driven by the proliferation of mobile devices and the increasing reliance on data-intensive applications. According to recent estimates, the number of mobile subscriptions is projected to reach 8 billion by 2026, necessitating robust infrastructure to support this growth. Distributed antenna systems (DAS) provide a viable solution by improving signal strength and coverage in densely populated areas. This trend is likely to continue, as businesses and municipalities seek to invest in advanced communication technologies to meet the expectations of consumers and ensure seamless connectivity.

Technological Advancements in Antenna Systems

The Distributed Antenna Systems Market is benefiting from rapid technological advancements in antenna systems. Innovations such as MIMO (Multiple Input Multiple Output) technology and beamforming techniques are enhancing the performance and efficiency of DAS. These advancements allow for better signal quality and coverage, addressing the challenges posed by increasing data traffic and user demands. The market for advanced antenna technologies is projected to grow, driven by the need for improved wireless communication solutions. As organizations seek to leverage these technologies, the demand for sophisticated DAS solutions is likely to rise, positioning them as a key driver in the evolving telecommunications landscape.

Increased Focus on Public Safety Communications

The Distributed Antenna Systems Market is witnessing a heightened focus on public safety communications. Governments and organizations are increasingly recognizing the importance of reliable communication systems during emergencies. DAS solutions are being deployed in critical infrastructure such as hospitals, airports, and stadiums to ensure uninterrupted communication for first responders. The market for public safety DAS is expected to grow significantly, driven by regulatory mandates and the need for enhanced emergency response capabilities. This trend underscores the essential role of DAS in safeguarding public safety, making it a crucial driver in the market as stakeholders prioritize investments in robust communication systems.