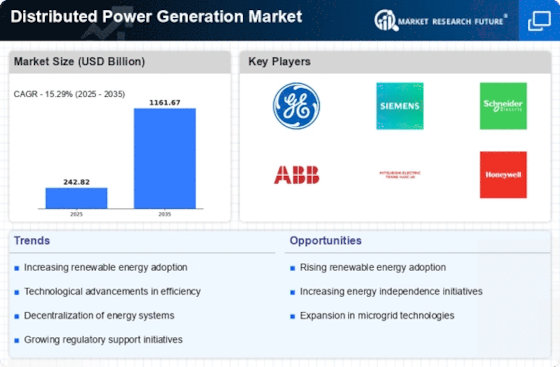

Rising Energy Demand

The Distributed Power Generation Market is experiencing a notable surge in energy demand, driven by urbanization and industrial growth. As populations expand and economies develop, the need for reliable and efficient energy sources becomes paramount. This trend is particularly evident in regions where traditional grid infrastructure is either insufficient or outdated. According to recent data, energy consumption is projected to increase by approximately 25% by 2030, necessitating innovative solutions. Distributed power generation offers a viable alternative, allowing for localized energy production that can alleviate pressure on central grids. This shift not only enhances energy security but also promotes sustainability, as distributed systems often incorporate renewable sources. Consequently, the rising energy demand is a significant driver for the Distributed Power Generation Market, encouraging investments in decentralized energy solutions.

Technological Innovations

Technological advancements play a crucial role in shaping the Distributed Power Generation Market. Innovations in energy generation, such as solar photovoltaic systems, wind turbines, and microgrids, have made distributed generation more efficient and cost-effective. For instance, the efficiency of solar panels has improved significantly, with some models achieving over 20% efficiency. Additionally, the integration of smart grid technologies facilitates better management of distributed energy resources, optimizing their performance and reliability. The emergence of Internet of Things (IoT) applications further enhances monitoring and control capabilities, allowing for real-time data analysis and decision-making. As these technologies continue to evolve, they are likely to drive down costs and increase the adoption of distributed power generation solutions. This technological momentum is a key factor propelling the growth of the Distributed Power Generation Market.

Regulatory Frameworks and Incentives

The regulatory landscape surrounding the Distributed Power Generation Market is evolving, with many governments implementing supportive policies and incentives. These frameworks are designed to encourage the adoption of distributed energy resources, such as tax credits, rebates, and feed-in tariffs. For example, certain jurisdictions have established net metering policies that allow consumers to sell excess energy back to the grid, creating a financial incentive for investment in distributed generation systems. Additionally, regulatory bodies are increasingly recognizing the importance of energy independence and resilience, leading to favorable legislation for decentralized energy solutions. This supportive environment is likely to stimulate market growth, as stakeholders seek to capitalize on the benefits of distributed power generation. Consequently, the regulatory frameworks and incentives are pivotal drivers for the Distributed Power Generation Market.

Economic Viability and Cost Reduction

The economic landscape of the Distributed Power Generation Market is shifting, with decreasing costs associated with renewable energy technologies. The price of solar panels, for instance, has dropped by over 80% in the last decade, making solar energy more accessible to consumers and businesses alike. This trend is complemented by advancements in energy storage solutions, which enhance the feasibility of distributed generation systems. As the cost of battery storage continues to decline, the ability to store and utilize energy generated from renewable sources becomes increasingly viable. Furthermore, the potential for reduced energy bills and increased energy independence adds to the economic appeal of distributed power generation. As a result, the economic viability and cost reduction are significant drivers for the Distributed Power Generation Market, encouraging widespread adoption of decentralized energy solutions.

Environmental Concerns and Sustainability

Growing environmental concerns are increasingly influencing the Distributed Power Generation Market. As awareness of climate change and pollution rises, there is a collective push towards sustainable energy solutions. Distributed power generation, particularly from renewable sources, aligns with these sustainability goals by reducing greenhouse gas emissions and minimizing reliance on fossil fuels. Data indicates that transitioning to distributed energy systems could potentially reduce carbon emissions by up to 70% in certain regions. Furthermore, local energy production diminishes transmission losses, enhancing overall energy efficiency. This alignment with environmental objectives is prompting governments and organizations to invest in distributed generation technologies. As a result, the emphasis on sustainability is a significant driver for the Distributed Power Generation Market, fostering a shift towards cleaner energy practices.