Technological Innovations

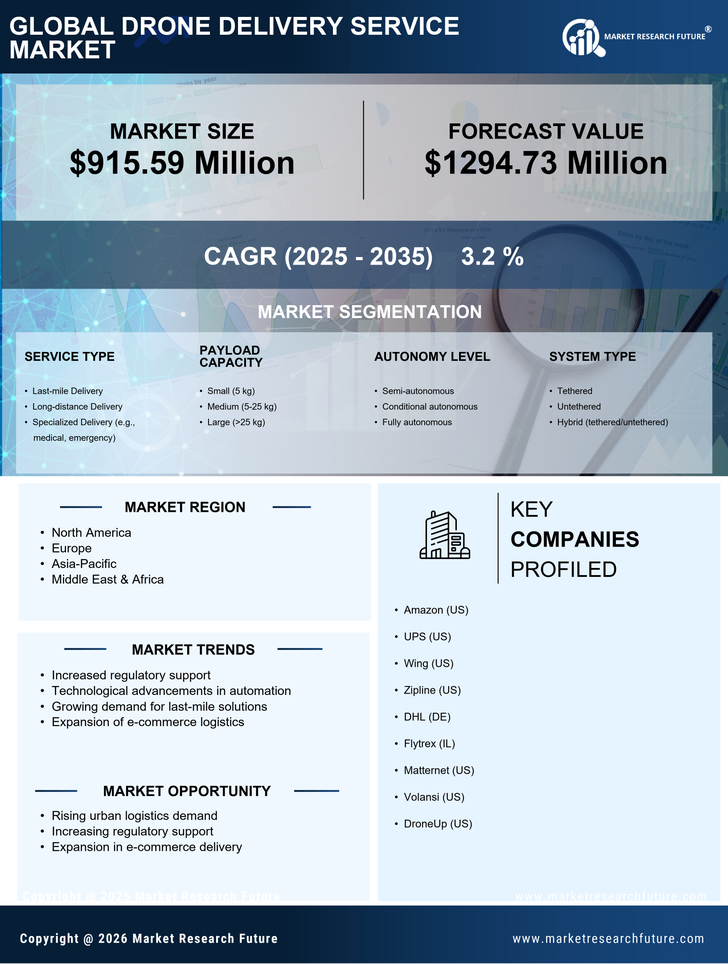

Technological innovations play a crucial role in shaping the Drone Delivery Service Market. Advancements in drone design, navigation systems, and battery life are enhancing the feasibility and reliability of drone deliveries. For instance, the integration of artificial intelligence and machine learning is improving route optimization and safety protocols. As technology continues to evolve, the capabilities of drones expand, allowing for more complex delivery scenarios. The market is projected to grow significantly, with estimates suggesting a valuation of over 10 billion dollars by 2027. This growth is largely attributed to ongoing research and development efforts aimed at refining drone technology, thereby solidifying the Drone Delivery Service Market's position in the logistics landscape.

Cost Efficiency in Logistics

Cost efficiency remains a pivotal driver in the Drone Delivery Service Market. Drones offer a potential reduction in operational costs compared to traditional delivery methods, particularly in last-mile logistics. Studies indicate that drone deliveries can lower transportation costs by up to 30%, making them an attractive option for businesses aiming to optimize their supply chains. This financial incentive encourages companies to adopt drone technology, as it not only enhances delivery speed but also reduces labor and fuel expenses. Consequently, the Drone Delivery Service Market is likely to witness increased adoption rates as businesses recognize the long-term savings associated with drone logistics.

Regulatory Support and Frameworks

Regulatory support is increasingly influencing the Drone Delivery Service Market. Governments are establishing frameworks to facilitate the safe integration of drones into airspace, which is essential for widespread adoption. Recent initiatives include the development of air traffic management systems specifically designed for unmanned aerial vehicles. These regulations aim to ensure safety while promoting innovation within the industry. As regulatory bodies continue to refine their policies, the market is likely to experience accelerated growth. The establishment of clear guidelines not only enhances public confidence in drone deliveries but also encourages investment in the Drone Delivery Service Market, paving the way for future advancements.

Increased Demand for Fast Delivery

The Drone Delivery Service Market experiences a notable surge in demand for rapid delivery solutions. Consumers increasingly expect swift service, particularly in e-commerce and food delivery sectors. This trend is evidenced by a projected growth rate of 20% annually in the drone delivery segment, as businesses seek to enhance customer satisfaction through expedited logistics. Companies are investing in drone technology to meet these expectations, thereby driving innovation and competition within the market. The need for speed in delivery services is reshaping logistics strategies, compelling traditional delivery methods to adapt or risk obsolescence. As a result, the Drone Delivery Service Market is positioned to capitalize on this growing consumer preference for immediacy.

Environmental Sustainability Initiatives

Environmental sustainability initiatives are becoming a driving force in the Drone Delivery Service Market. As concerns over carbon emissions and environmental impact grow, companies are exploring eco-friendly delivery options. Drones, which typically produce lower emissions compared to traditional delivery vehicles, present a viable solution for reducing the carbon footprint of logistics operations. The market is witnessing a shift towards sustainable practices, with projections indicating that eco-conscious consumers are more likely to choose services that prioritize environmental responsibility. This trend is prompting businesses to invest in drone technology as part of their sustainability strategies, thereby enhancing the appeal of the Drone Delivery Service Market.