Drone Simulator Size

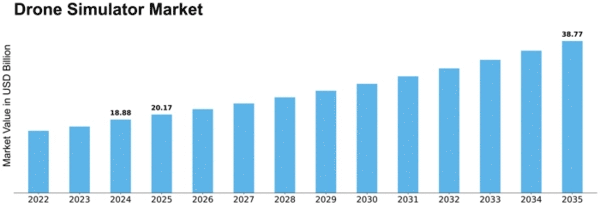

Drone Simulator Market Growth Projections and Opportunities

Drone Simulators Market Size Is Projected To Grow At A 15% CAGR By 2021–2030, Reaching USD 143.5 Billion By 2030.

The Drone Simulator market is influenced by a multitude of factors that collectively shape its dynamics and growth. Technological advancements in unmanned aerial vehicle (UAV) technology drive the demand for drone simulators. As drones become increasingly sophisticated and integral to various industries, the need for realistic and effective training simulations grows. Drone simulators provide a safe and cost-effective environment for operators to develop their piloting skills, familiarize themselves with different UAV models, and practice maneuvers in diverse scenarios.

Regulatory frameworks and evolving licensing requirements contribute significantly to the dynamics of the Drone Simulator market. As authorities worldwide implement stricter regulations for drone operations, the demand for training solutions that facilitate compliance with these regulations rises. Drone simulators play a crucial role in helping operators understand and adhere to airspace restrictions, flight limitations, and safety protocols mandated by aviation authorities.

Economic factors, including the cost of drone ownership and training, impact the adoption of drone simulators. The initial investment in a drone simulator is often lower than the cost of purchasing and maintaining an actual drone. This cost-effectiveness makes simulators an attractive option for individuals and organizations looking to train operators without the associated expenses of fuel, repairs, and potential damage to physical drones. Economic downturns may further drive the preference for simulator-based training as businesses seek cost-efficient alternatives.

The expanding scope of drone applications across industries influences the demand for specialized training provided by drone simulators. From aerial photography and agriculture to search and rescue operations, different sectors require specific skills and expertise in drone operations. Simulators tailored to these industries enable operators to practice tasks, maneuvers, and emergency responses relevant to their field, contributing to the overall proficiency and effectiveness of drone usage.

The competitive landscape among drone simulator providers is a key market factor. Companies vie for market share by offering a diverse range of simulation solutions, including varying drone models, realistic environments, and advanced training modules. The ability to replicate real-world conditions, provide accurate physics modeling, and offer comprehensive training scenarios distinguishes leading simulator providers in a competitive market.

Advancements in simulation technology, such as virtual reality (VR) integration, enhance the realism and effectiveness of drone training. VR-based drone simulators provide a more immersive experience, allowing operators to feel as though they are piloting a drone in a true-to-life environment. The adoption of VR technologies in drone simulators reflects the ongoing commitment to improving the quality of training and preparing operators for diverse and challenging scenarios.

Environmental considerations are gradually influencing the Drone Simulator market, aligning with the broader trend of sustainability in technology. By reducing the reliance on physical drones for training purposes, simulators contribute to a reduction in energy consumption and environmental impact associated with manufacturing and operating actual UAVs. This aligns with the growing emphasis on eco-friendly practices in the drone industry.

Leave a Comment