Research Methodology on Helicopter Simulator Market

Introduction

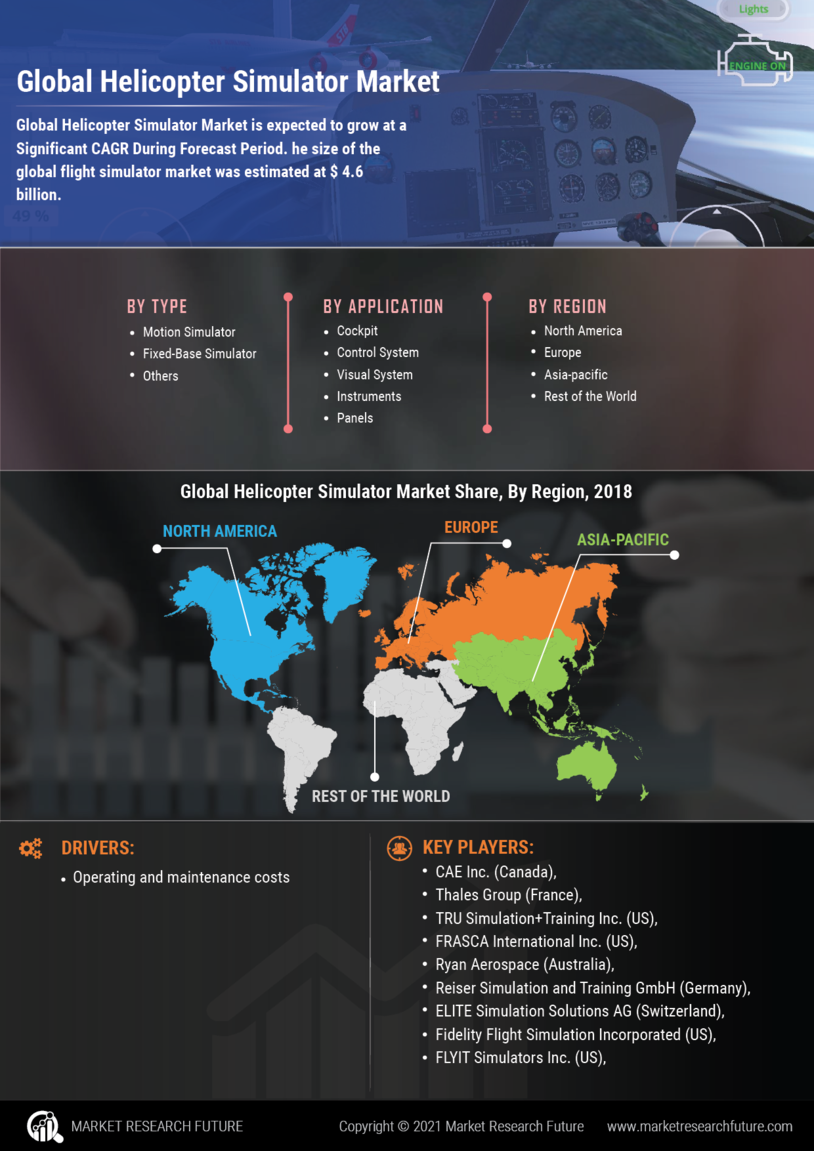

Market Research Future (MRFR) has published a research report focusing on the global Helicopter Simulator Market. The Helicopter Simulator Market is projected to display an impressive growth rate during the forecast period 2023 to 2030. Helicopter simulators are used for many different purposes, such as the preparation and evaluation of pilots, the testing of products and services, the development and training of maintenance technicians, and many other applications. The main focus of the report is on the overall market, segmentation based on various criteria, technological advancements, and other industry-related elements.

Research Methodology

In order to generate accurate estimates and forecasts related to the Helicopter Simulator Market, it was necessary to obtain primary and secondary knowledge from various sources. A robust methodology has also been employed to ensure that the research efforts are in alignment with the research objectives and requirements. This research methodology can provide an informative basis upon which the rest of the research can be built.

The primary research phase includes interviews with relevant stakeholders in the Helicopter Simulator Market. To obtain comprehensive and accurate information, the interviews include those from government bodies, industry experts, practitioners, public institutions, industry associations, and other agencies. After obtaining relevant information from these sources, the information was then analyzed and integrated into the body of the research.

The secondary research phase also contributes to gathering crucial information related to the Helicopter Simulator Market. These sources included journals, industry magazines, newspapers, research databases, books, and annual reports, among others. Various business strategies, market trends, and industry shares were also taken into consideration for the research.

The information collected from the primary sources and secondary sources was then compiled, integrated and analyzed. This data was then used to create a thorough and informative report on the Helicopter Simulator Market.

The report outlines the major drivers, restraints, and opportunities in the Helicopter Simulator Market. Anode year-on-year analysis has been conducted to identify the overall progression of the Market. Moreover, the report covers the competitive analysis of leading participants in the Market. Porter's Five Forces Model has been used to evaluate the competitive landscape of the market. The report also provides a qualitative analysis of the various factors driving the Helicopter Simulator Market.

Research Findings

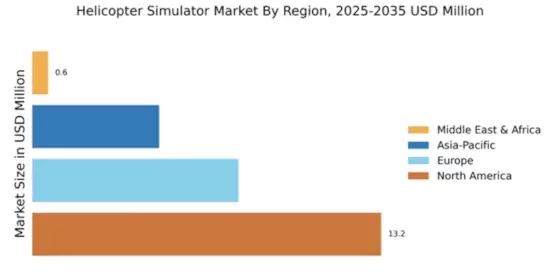

The research report on the Helicopter Simulator Market provides an in-depth analysis of the current market conditions. The report also presents a comprehensive overview of the market size, share, demand & supply analysis, sales volume, and growth prospects of the market. An in-depth segmentation analysis has been used to provide insights into the various segments of the Helicopter Simulator Market.

The report also provides comprehensive insights into the competitive landscape of the market. A detailed analysis of the key players and their strategies has been included in the report. The report also provides an analysis of the strategies of each of the major players in the market. The marketing and sales strategies of each major player have been thoroughly analyzed in the report.

The report also provides an extensive assessment of the current market trends and their impact on the evolution of the Helicopter Simulator Market over the forecast period 2023 to 2030. The report also provides an in-depth analysis of the impact of the new entrants and the impact of the new entrants on the evolution of the Helicopter Simulator Market. The report also provides detailed insights into the opportunities and challenges faced by the major market participants in the market.

Conclusion

The research report on the Helicopter Simulator Market provides a comprehensive overview of the market from 2023 to 2030. This report will act as a valuable source of information for the Industry Personnel, players, stakeholders, investors, and other parties interested in the market. The report provides a detailed analysis of the various segments of the market and the growth prospects for each segment, as well as the competitive landscape of the market.