Research Methodology on e-Scooters market

Introduction

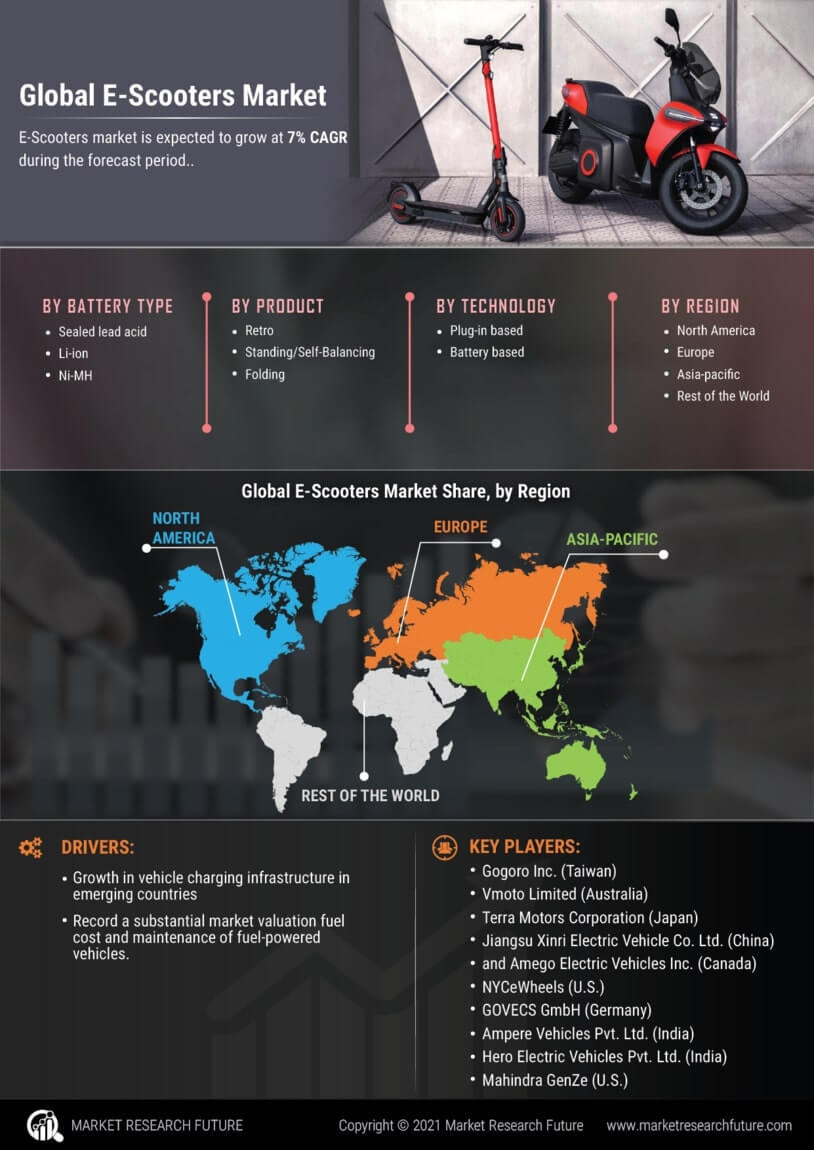

This research focuses specifically the market and opportunity analysis of the e-scooters market. We will review the factors that are driving or constraining the growth of the e-scooter market, analyze the competitive landscape of the e-scooter market and provide an outlook for the future.

Research Objectives

The primary objective of this research is to identify the factors that are driving or constraining the growth of the e-scooters market, analyze the competitive landscape of the e-scooter market and provide an outlook for the future.

To accomplish the stated research objectives, the following research objectives will be addressed:

- Identify the key factors driving the growth of the e-scooters market.

- Assess the current competitive landscape of the e-scooters market and identify key players in the e-scooter market.

- Analyze the outlook for growth of the e-scooters market.

Research Methodology

The research methodology adopted for this research is a mixed-method approach that combines qualitative and quantitative research methods. A combination of primary and secondary research is used to collect data, which is subsequently analyzed and interpreted in order to provide market and opportunity analysis.

The primary research component of this research involves interviews with executives from companies in the e-scooters space, as well as research analysts working in the industry.

The secondary research component of this research involves reviewing the available market publications, industry reports, and company-provided documents, as well as utilizing other relevant sources of market data. This data is collated, analyzed and interpreted to provide the current state of the e-scooters market and an outlook for the sector.

Data Analysis

The data analysis is used to synthesize the qualitative and quantitative data collected through the primary and secondary research. This analysis is used to identify key trends and drivers in the e-scooters market, assess the competitive landscape of the e-scooter market, and provide an outlook for the future.

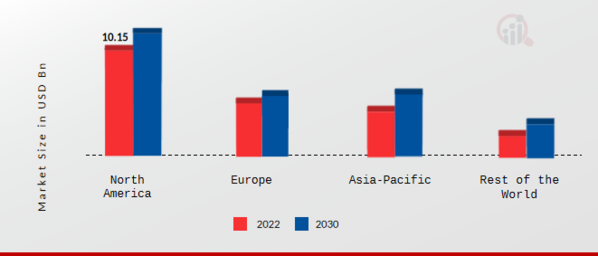

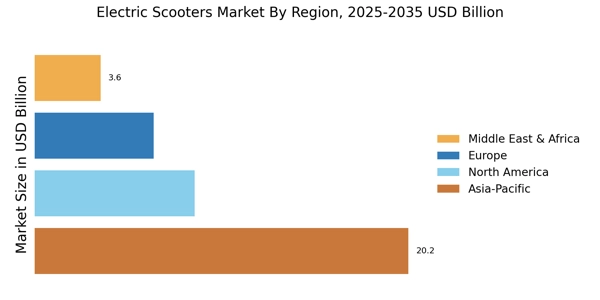

The analysis is conducted using multiple tools, including a market sizing analysis utilizing market size estimates, growth forecasts, and market share estimation; a market trends analysis to identify key trends and drivers of the e-scooters market; and a competitive landscape analysis to identify leading players in the e-scooter market.

Conclusion

This research provides an in-depth analysis of the e-scooters market and its future outlook. The research identifies key factors driving the growth of the e-scooters market and analyzes the competitive landscape of the e-scooter market to identify key players and trends. This research provides a comprehensive overview of the e-scooter market and its potential growth opportunities.