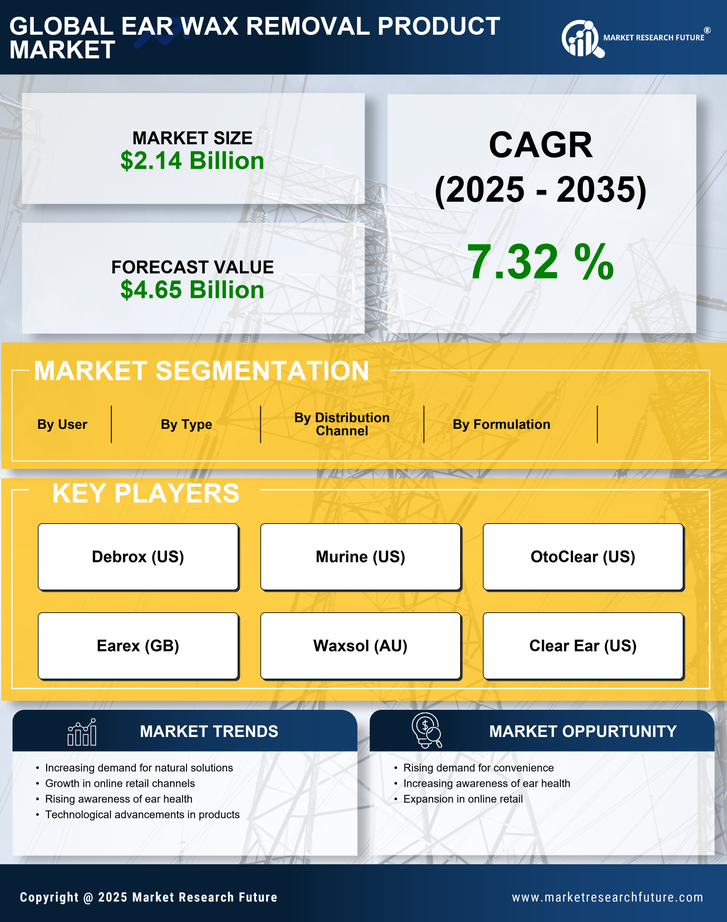

Growing Awareness of Ear Health

The increasing awareness regarding ear health is a pivotal driver for the ear wax removal product Market. Consumers are becoming more informed about the potential risks associated with excessive ear wax buildup, such as hearing loss and infections. This heightened awareness is leading to a surge in demand for effective ear wax removal solutions. According to recent data, the ear care market is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. As individuals prioritize their health, the focus on maintaining ear hygiene is likely to propel the sales of ear wax removal products, thereby enhancing the overall market landscape.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is a crucial driver for the Ear Wax Removal Product Market. As individuals become more proactive about their health, there is a rising interest in products that prevent potential health issues. This trend is reflected in the increasing sales of ear wax removal products, as consumers recognize the importance of regular ear hygiene in preventing complications. Market analysis indicates that preventive healthcare products are gaining traction, with consumers willing to invest in solutions that promote long-term health. This shift towards prevention is likely to sustain the growth of the ear wax removal market, as more individuals seek to incorporate these products into their health routines.

Rising Demand for Home Healthcare Solutions

The trend towards home healthcare solutions is a significant driver for the Ear Wax Removal Product Market. As consumers increasingly prefer to manage their health at home, the demand for ear wax removal products is likely to rise. This shift is partly attributed to the convenience and privacy associated with home care. Market data indicates that the home healthcare market is expected to grow substantially, with a notable increase in the adoption of self-care products. Consequently, ear wax removal products are becoming essential items in home healthcare kits, further propelling market growth as consumers seek effective and safe solutions for ear hygiene.

Technological Advancements in Product Design

Technological innovations are significantly influencing the Ear Wax Removal Product Market. The introduction of advanced tools, such as ear wax removal kits equipped with soft silicone tips and LED lights, is enhancing user experience and safety. These innovations not only improve the efficacy of ear wax removal but also cater to a broader audience, including those who may have previously avoided such products due to safety concerns. The market is witnessing a shift towards more user-friendly and efficient solutions, which is likely to attract new consumers and retain existing ones. As a result, the market is expected to expand as these products become more accessible and appealing.

Influence of E-commerce on Product Accessibility

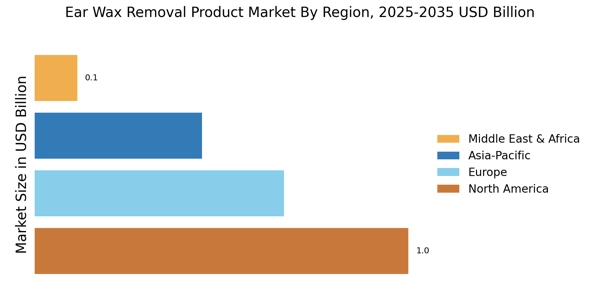

The expansion of e-commerce platforms is transforming the Ear Wax Removal Product Market by enhancing product accessibility. Consumers are increasingly turning to online shopping for convenience and a wider selection of products. E-commerce allows for easy comparison of different ear wax removal solutions, enabling consumers to make informed choices. Recent statistics suggest that online sales in the personal care sector are experiencing rapid growth, which is likely to benefit the ear wax removal segment. As more consumers opt for online purchases, the market is expected to see a significant uptick in sales, driven by the ease of access and the ability to reach a broader audience.