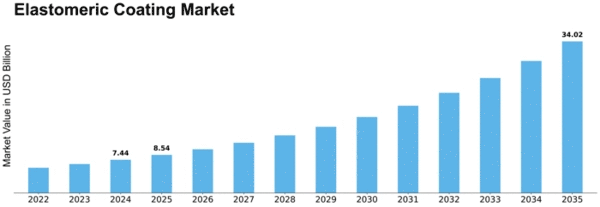

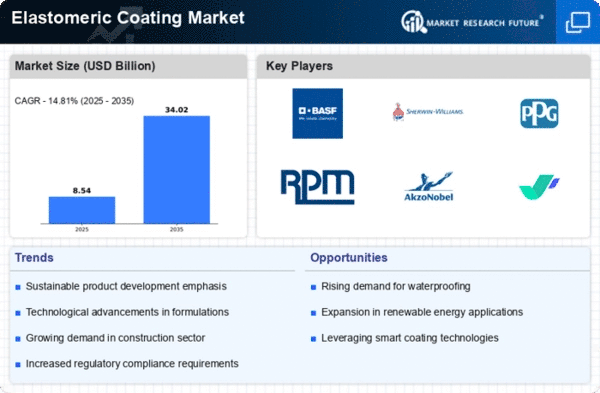

Elastomeric Coating Size

Elastomeric Coating Market Growth Projections and Opportunities

Different factors govern the Elastomeric Coatings Market's aspects and growth. The development industry's demand for tough and climate-safe coatings drives the Elastomeric Coatings Market. Outside wall coatings for residential, corporate, and modern buildings use elastomeric coatings due to their adaptability, elasticity, and ability to mend fractures. The global focus on foundation development and the need for protective and energy-efficient coatings drive market growth, highlighting elastomeric coatings' role in development.

Development affects the Elastomeric Coatings Market. Elastomeric coatings waterproof, prevent breakage, and strengthen patterns on cement, plaster, and stone surfaces. The market grows because people want coatings that can withstand extreme weather, UV radiation, and temperature changes. Elastomeric coatings' ability to expand and contract with building surfaces, allowing underlying developments, makes them ideal for lasting and affordable defensive coatings.

Energy efficiency and maintainability make elastomeric coatings popular. These coatings often contain intelligent qualities that reduce structure intensity, reducing cooling energy use. As energy-efficient development practices gain traction globally, the Elastomeric Coatings Market meets the growing need for coatings that offer warmth and energy reserve funds to structures.

Geological factors and environmental concerns shape the Elastomeric Coatings Market. Due to their ability to withstand temperature changes and protect structures from moisture, elastomeric coatings are more popular in areas with extreme weather. The market responds to local environmental, construction, and administrative conditions by fitting elastomeric covering details to meet ecological issues. Environmental standards and maintainability considerations shape the Elastomeric Coatings Market. Water-based and low-VOC elastomeric coatings are in demand as companies consider the environmental impact of coatings. Following strict criteria and researching eco-friendly strategies boosts the industry. Market responds to business' need to reduce natural impression and advance economic structure practices.

Buyer preferences and market trends also shape the Elastomeric Coatings Market. As customers and businesses grow more mindful of supportability, energy efficiency, and building exteriors, elastomeric coatings with defensive and decorative features are becoming more popular. The market adapts to engineering design trends that require elastomeric coatings for practical and aesthetic goals.

Leave a Comment