Research Methodology on Electric Bus Charging Infrastructure Market

Introduction

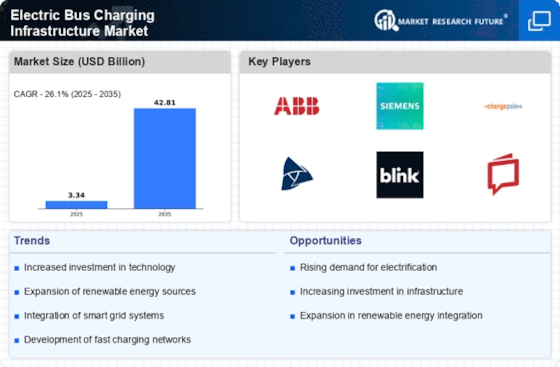

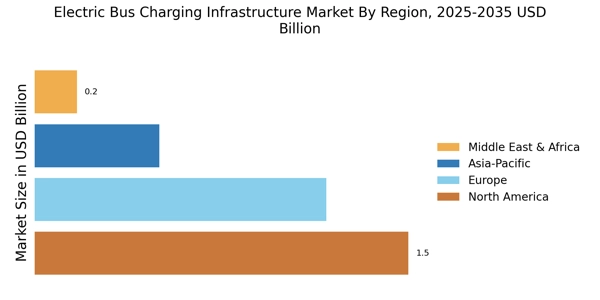

The Electric Bus Charging Infrastructure market is expected to register a substantial Compound Annual Growth Rate (CAGR) over the forecast period, 2023-2030. The increased focus on the scope for electrification in the automotive industry has meant that the establishment of electric bus charging infrastructure is seeing significant uptake from government bodies. Demand for buses has seen robust exponential growth in the Asia Pacific, Japan, North America, Europe, and other parts of the world. This is expected to drive the growth of the electric bus charging infrastructure market over the forecast period 2023 to 2030.

The research has been conducted to understand the current market trends and the potential development of the Electric Bus Charging Infrastructure market globally. The research methodology is based on the scientific, market analysis approach and the business goals set by the company. The methodology consists of primary and secondary research which is used to provide insights into the current and future market trends. Furthermore, it helps to gain information, which is useful in making strategic and tactical decisions to achieve business objectives. The research methodology covers all aspects of the primary and secondary research.

Research Objectives

The primary objective of this research is to gain an understanding of the current market trends and the potential development of the Electric Bus Charging Infrastructure market globally. The secondary objectives of the research study are to assess the factors influencing the growth of the market, obtain information on the product offerings, investigate market sizing and growth forecasts, and gain insights into the key players in the market.

Research Approach

To understand the market dynamics and the potential growth of the Electric Bus Charging Infrastructure market globally, a primary and secondary research approach has been used in the research study. Primary research includes organized and structured interviews with industry experts, key stakeholders, and opinion leaders. Furthermore, secondary research includes analysis of relevant documents, surveys, blogs, and industry association databases. The primary and secondary research involved the following activities.

Primary Research

Primary research involves structured and organized interviews with industry experts, key stakeholders, and opinion leaders. The structured interviews were conducted to gain insights into the current and future market trends, to gain information on the product offering and rental services, and to identify the key players in the market. The primary sources of data have also been used to gain information on market sizing and growth forecasts. The structured interviews were conducted in person as well as via telephone, email, and surveys.

Secondary Research

Secondary research involved the analysis of relevant documents, surveys, world market reports, case studies, and industry association databases. It is also used to gain information on the market dynamics, emerging technologies and market entrants, gain insights into the pricing structure, and understand the buying behaviour in the market. The secondary sources of data were used to identify the competitive landscape of the market.

Data Collection

The process of data collection is a crucial step in the research study. The data is obtained from reliable and credible sources such as industry experts, key stakeholders, and opinion leaders. The primary and secondary research involves the following activities.

Primary Research

- Structured and organized interviews with industry experts, key stakeholders, and opinion leaders

- Identification of market data points and information through surveys

- Analysis of relevant documents, world market reports, case studies, and industry association databases

Secondary Research

- Identification of key players in the market

- Investigation of market dynamics, emerging technologies and market entrants

- Assessment of buying behaviour in the market

- Evaluation of the competitive landscape of the market

- Analysis of pricing structure

Data Analysis

The obtained data is then carefully analyzed and evaluated. The data was then used to draw meaningful conclusions and provide insights into the current and future trends in the Electric Bus Charging Infrastructure Market. The data was analyzed through both qualitative and quantitative methods.

The qualitative analysis included the use of indexing and coding of the text to provide patterns or trends in the data

Quantitative analysis was used to analyze the numerical aspects of the data and draw meaningful conclusions

The research study was carried out using various statistical tools such as SWOT analysis, regression models, Porter's Five Forces model, and others. The data was then used to prepare reports and make strategic decisions.

Results and Findings

The results of the research study indicated that the Electric Bus Charging Infrastructure market is expected to register a substantial compound annual growth rate (CAGR) over the forecast period, 2023-2030. The results also showed that government bodies are taking initiatives towards the establishment of electric bus charging infrastructure, which is expected to drive the growth of the market over the forecast period 2023 to 2030. Furthermore, market growth is also expected to be driven by the increased focus on the scope for electrification in the automotive industry. The results also indicated that the key players in the market are investing heavily in the research and development of new, efficient solutions for electric bus charging.

Conclusion

The research study has provided an in-depth analysis of the Electric Bus Charging Infrastructure market, by exploring the current and future trends in the market as well as the key players. The study has analyzed the factors influencing the growth of the market, such as government initiatives, increased focus on electrification in the automotive industry, and R&D of new solutions. The results have indicated that the market is expected to register a substantial compound annual growth rate (CAGR) over the forecast period, 2023-2030.