Top Industry Leaders in the Electric Construction Vehicles Market

The construction industry, long known for its rumble of diesel engines and towering plumes of exhaust, is experiencing a quiet revolution. Electric construction vehicles (ECVs) are rapidly gaining traction, driven by environmental concerns, cost-effectiveness, and technological advancements. This has sparked a dynamic competitive landscape, with established players and nimble startups vying for a piece of the pie.

Strategies Powering Market Share:

-

Product Diversification: Leading companies like Caterpillar, Volvo Construction Equipment, and JCB are expanding their ECV portfolios beyond traditional excavators and dump trucks. They're now offering electric forklifts, skid steers, compact loaders, and even concrete mixers, catering to a wider range of needs.

-

Technological Innovation: Players are investing heavily in battery technology, charging infrastructure, and automation to improve ECV performance, range, and efficiency. For example, John Deere's electric excavator boasts a powerful lithium-ion battery pack and rapid charging capabilities, minimizing downtime.

-

Strategic Partnerships and Acquisitions: Collaboration is key in this fast-paced market. Partnerships like Volvo CE and Mack Trucks' joint development of electric dump trucks, or Komatsu's acquisition of battery-electric drivetrain specialist Off-Highway Systems, provide access to expertise and resources for faster growth.

-

Sustainability Focus: ECVs align perfectly with environmental goals, attracting eco-conscious customers and regulatory support. Companies are highlighting the reduced emissions, quieter operation, and improved air quality that electric construction equipment offers.

-

Cost-Effectiveness: While upfront costs might be higher, ECVs offer long-term savings through lower fuel and maintenance expenses. Fleet operators are increasingly recognizing this, pushing demand for electric solutions.

Factors Shaping Market Dynamics:

-

Government Regulations and Incentives: Stringent emission regulations in regions like Europe and California are driving ECV adoption. Additionally, subsidies and tax breaks for electric equipment further incentivize investment. -

Fuel Prices and Energy Security: Fluctuations in fossil fuel prices and concerns about energy security make the stable cost of electricity an attractive proposition for construction companies. -

Technological Advancements in Batteries and Charging: As battery range and charging speeds improve, range anxiety diminishes, making ECVs more viable for diverse construction projects. -

Infrastructure Development: Building a robust charging network across construction sites is crucial for widespread ECV adoption. Partnerships between industry players and governments are accelerating this process. -

Customer Awareness and Perception: Raising awareness of ECV benefits and dispelling myths about performance limitations is essential. Successful case studies and demonstrations are playing a critical role in changing perceptions.

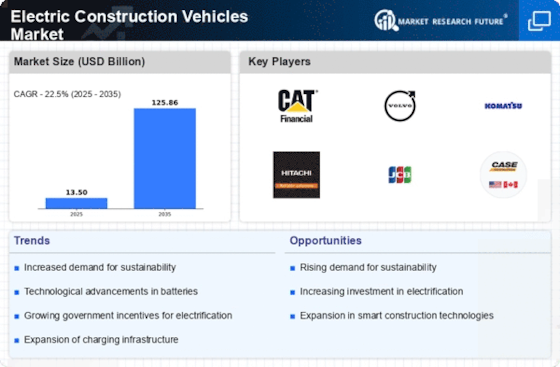

Key Players:

- Volvo

- Komatsu

- Atlas Copco

- John Deere

- Merlo J C Bamford Excavators Ltd.

- Caterpillar

- CNH Industrial N.V.

- SUNWARD

- Doosan Corporation

- Atkins Nutritionals Inc.

Recent Developments:

September 2023: JCB unveils the world's first fully electric backhoe loader, the 1BEV.

October 2023: Volvo Construction Equipment launches a new electric wheel loader, the L25 Electric, with a focus on compact urban construction.

November 2023: The US Department of Energy announces a $7 billion investment in clean energy technologies, including funding for ECV development.

December 2023: XCMG, a Chinese construction machinery giant, announces plans to invest $1 billion in ECV research and development over the next five years.