Electric Construction Vehicles Size

Electric Construction Vehicles Market Growth Projections and Opportunities

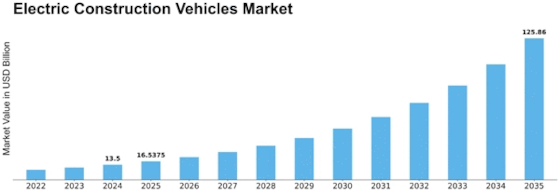

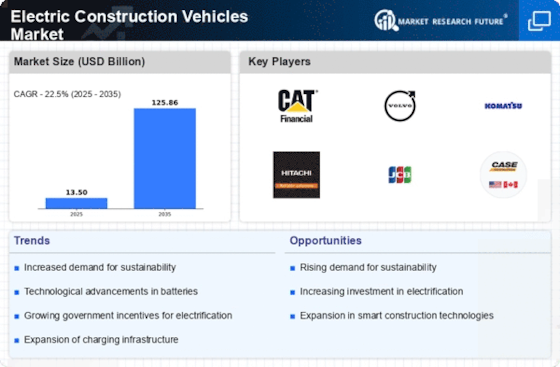

Electric Construction Vehicles Market Size is experiencing a financial boom in their business due to certain critical factors. One of the most important reasons for this phenomenon lies in the increasingly global quest for sustainable practices and environmental awareness. As governments and industries worldwide seek to cut down carbon emissions and promote cleaner technologies, electric construction vehicles have emerged as a way out in construction sector. The Electric Construction Vehicles Market Size reached USD 9 Billion by 2022. The electric construction vehicles industry is estimated to grow from USD 11.02 Billion in 2023 to USD 55.90 Billion by 2032 at a CAGR of 22.50%.

Another key market factor is sky-rocketing fuel prices that have prompted constructors to look for more cost-effective and fuel efficient alternatives. Electric construction vehicles provide an attractive option through significant reduction of operating costs stemming from reduced fuel consumption and maintenance charges. This economic advantage has become one of the reasons behind implementing electric construction vehicles within different types of construction projects.

Additionally, technological advancements also have their own sway on the electric construction vehicle market dynamics. Continuous innovation in battery technology and electronic drivetrains have resulted into improved performance as well as efficiency related with electric versions used for building purposes .In this regard improvements such as increased battery life spans, faster charging rates along with higher power densities have helped address initial concerns connected with EVs thus making them more appealing to players within the building sector.

Government incentives and regulations are additional market factors influencing the growth of electric construction vehicles. Many governments around the world are introducing policies and incentives to encourage adoption of electric vehicles including equipment used in constructions such as bulldozers among others Tax credits, subsidies, regulatory frameworks encouraging use of eco-friendly options among other things are part of these measures undertaken by some countries wherein reason firms tend investing into EVs.Mostly nowadays companies opt for these products often driven by motive not only profit but also need to fulfil requirements of new environmental legislation.

Furthermore, the market growth is being stimulated by increasing awareness of long-term benefits of using electric construction vehicles in construction industry. Beyond the immediate advantages of cost savings and environmental impact, electric construction vehicles are often perceived as a strategic investment for future-proofing operations. For construction companies that incorporate sustainable practices into their building processes, there is a clear potential for enhanced brand reputation and customer appeal.

Market factors are also influenced by the changing preferences of consumers and stakeholders. With an increase in demand for green and sustainable constructions, contractors and project owners feel the need to reduce their carbon footprints. Electric construction vehicles offer a tangible solution to achieve this objective, which corresponds to evolving expectations from customers as well as financiers preferring environmentally conscious projects in construction.

Leave a Comment