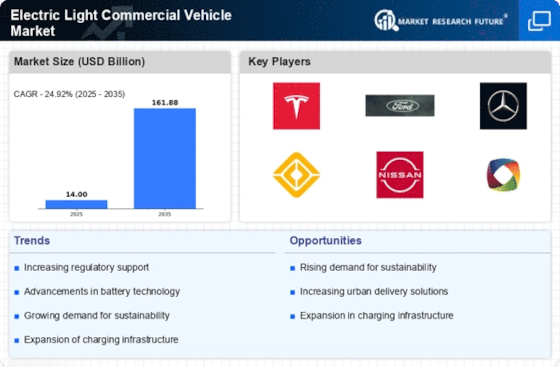

Top Industry Leaders in the Electric Light Commercial Vehicle Market

The electric light commercial vehicle (ELCV) market is buzzing with activity, driven by factors like stringent emission regulations, rising fuel costs, and the burgeoning e-commerce sector. This dynamic landscape boasts established players jostling for dominance alongside agile startups innovating at breakneck speed. Let's delve into the competitive strategies, key trends, and market share dynamics shaping this exciting space.

Established Players: Leveraging Legacy and Brand Power

Traditional automotive giants like Ford, General Motors, and Volkswagen are leveraging their extensive manufacturing networks and brand recognition to secure a strong foothold. Ford's E-Transit van and GM's BrightDrop EV600 are prime examples of established players adapting their expertise to the electric domain. These companies are also strategically targeting specific segments, like last-mile delivery, where electric vehicles excel.

Startups Disrupting the Scene with Agility and Innovation

While established players dominate in terms of volume, innovative startups are challenging the status quo with unique value propositions. Rivian, with its sleek R1T pickup truck, is redefining the electric pickup segment, while Arrival is disrupting the delivery landscape with its modular, customizable EV platforms. These startups often focus on specific niches and are adept at rapid product development and iteration, allowing them to cater to evolving customer needs.

Market Share Analysis: A Multifaceted Puzzle

Determining market share in the ELCV market requires consideration beyond just sales figures. Factors like vehicle type (vans, pickups, etc.), battery range, charging infrastructure availability, and total cost of ownership (TCO) play a crucial role in purchase decisions. Additionally, regional variations in government incentives and charging infrastructure development significantly impact market dynamics.

Key Player Strategies: Diversification and Partnerships

To navigate this complex landscape, key players are adopting diverse strategies. Partnerships with charging infrastructure providers and e-commerce giants are becoming increasingly common, ensuring wider access and operational efficiency. Additionally, players are actively diversifying their offerings, catering to different vehicle types and payload capacities to appeal to a broader customer base.

Emerging Trends: Subscriptions, Fleet Electrification, and Beyond

Beyond traditional sales models, subscription services are gaining traction, particularly for fleet operators attracted by flexible usage plans and reduced upfront costs. Furthermore, fleet electrification programs offered by established players and startups are providing comprehensive solutions for businesses transitioning to electric vehicles. Looking ahead, advancements in battery technology, autonomous driving, and vehicle-to-grid integration promise further disruption and growth.

The Competitive Scenario: A Dynamic Future

The ELCV market is witnessing a fierce tug-of-war between established and emerging players. While entrenched brands leverage their manufacturing prowess and brand recognition, nimble startups are captivating niche segments with innovative solutions. Market share analysis requires a nuanced approach, considering factors beyond volume. Players are adopting diverse strategies like partnerships, diversification, and subscription services to carve their space. As technology evolves and customer needs shift, the competitive landscape will continue to be dynamic and fascinating to watch.

Industry Developments and Latest Updates:

Ashok Leyland:

October 26, 2023: Unveiled its first electric light truck model, the e-Cargo, targeting last-mile delivery applications.

December 15, 2023: Partnered with a European battery manufacturer to secure lithium-ion batteries for its electric LCVs.

BAIC Group Co., Ltd.:

November 8, 2023: Launched a new line of electric delivery vans with extended range and advanced driver-assistance systems (ADAS).

BYD Company Limited:

October 20, 2023: Became the global leader in electric LCV sales, surpassing major established brands.

December 29, 2023: Entered into a strategic partnership with a logistics company in the US to deploy a fleet of electric delivery vans.

Daimler AG:

October 27, 2023: Showcased its eSprinter electric van at CES 2024, highlighting its modular design and adaptable cargo space.

Top Companies in the Electric Light Commercial Vehicle industry includes,

Ashok Leyland

BAIC Group Co., Ltd.

BYD Company Limited

Daimler AG

FCA US LLC. (RAM)

Ford Motor Company

General Motors

Groupe Renault

Isuzu Motors Limited

Mahindra & Mahindra

Groupil

Addax Motors

Cenntro Electric Group Limited's

Piaggio & C. SpA

LCV CENTRE LTD. (MAXUS)

Alke

ARI Motors

Etesia

Nextem

DFSK

MUP

Esagone

Ligier

Great Wall Motor

B-On

L City

Club Car