Expansion of Charging Infrastructure

The Electric Truck Chassis Market is poised for growth due to the ongoing expansion of charging infrastructure. The availability of fast-charging stations is crucial for the widespread adoption of electric trucks, as it alleviates range anxiety among fleet operators. Recent initiatives by both public and private sectors aim to increase the number of charging points, particularly along major transportation routes. This development is expected to enhance the operational feasibility of electric trucks, making them a more attractive option for logistics companies. As charging infrastructure continues to improve, the market for electric truck chassis is likely to see increased demand.

Rising Fuel Prices and Operational Costs

The Electric Truck Chassis Market is influenced by rising fuel prices and operational costs associated with traditional diesel trucks. As fuel prices fluctuate, companies are increasingly looking for cost-effective alternatives to maintain profitability. Electric trucks offer lower operating costs due to reduced fuel expenses and maintenance requirements. Data indicates that electric trucks can save fleet operators up to 30% in fuel costs compared to their diesel counterparts. This economic advantage is prompting more businesses to consider electric solutions, thereby driving growth in the electric truck chassis market.

Government Incentives and Regulatory Frameworks

The Electric Truck Chassis Market benefits significantly from government incentives and supportive regulatory frameworks aimed at promoting electric vehicle adoption. Various countries have implemented tax credits, grants, and subsidies to encourage the purchase of electric trucks. For example, some regions offer substantial rebates for electric vehicle purchases, which can lower the total cost of ownership. Additionally, stricter emissions regulations are compelling manufacturers to transition to electric solutions. This regulatory environment not only fosters innovation but also creates a favorable market landscape for electric truck chassis, as companies seek to comply with evolving standards.

Technological Innovations in Electric Truck Chassis

The Electric Truck Chassis Market is experiencing a surge in technological innovations, particularly in the development of lightweight materials and advanced battery systems. These innovations enhance the efficiency and performance of electric trucks, making them more appealing to fleet operators. For instance, the integration of composite materials can reduce the overall weight of the chassis, thereby increasing payload capacity and range. Furthermore, advancements in battery technology, such as solid-state batteries, promise longer life cycles and faster charging times. As a result, manufacturers are likely to invest heavily in research and development to stay competitive, which could lead to a more robust market landscape.

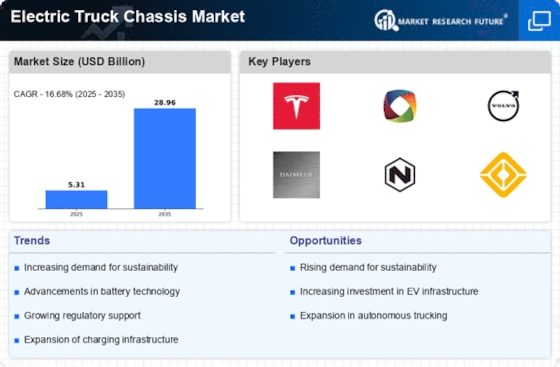

Increasing Demand for Sustainable Transportation Solutions

The Electric Truck Chassis Market is witnessing a growing demand for sustainable transportation solutions, driven by both consumer preferences and corporate responsibility initiatives. Companies are increasingly adopting electric trucks to reduce their carbon footprint and meet sustainability goals. According to recent data, the demand for electric trucks is projected to grow at a compound annual growth rate of over 20% in the coming years. This shift towards eco-friendly logistics not only aligns with regulatory pressures but also enhances brand reputation. As more businesses commit to sustainability, the market for electric truck chassis is likely to expand, attracting new entrants and investments.