Research Methodology on Electric Vehicle Connector Market

This Electric Vehicle Connector Market Report is compiled using primary and secondary research. Primary research involves interaction with market players such as product manufacturers, suppliers, and industry experts. Secondary research involves data studies by industry bodies, trade associations, and global organizations. The base year for the Report is 2022 and estimates span 2023-2030.

Introduction

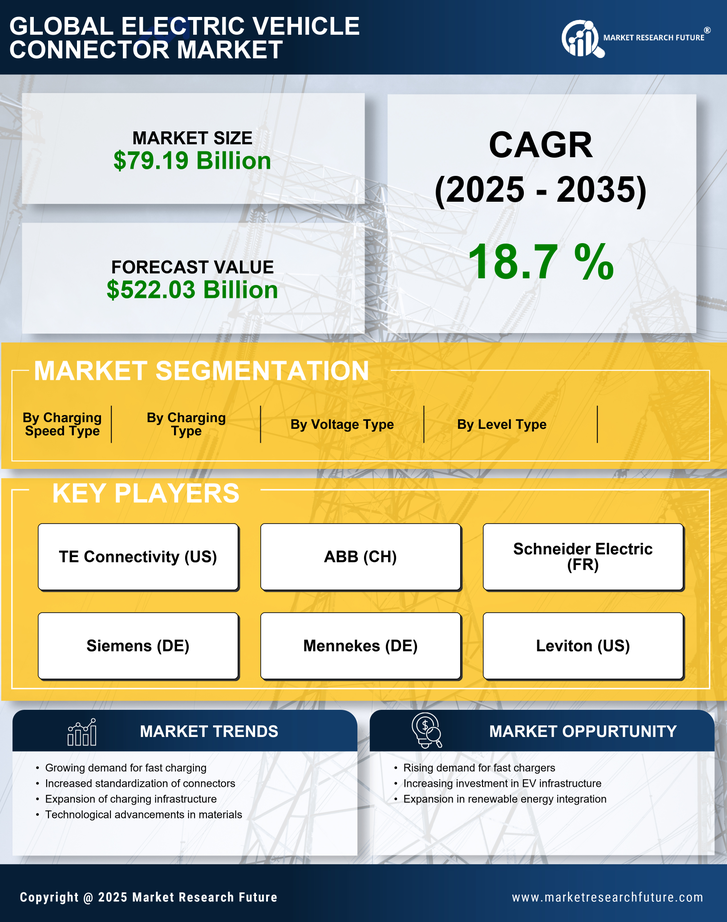

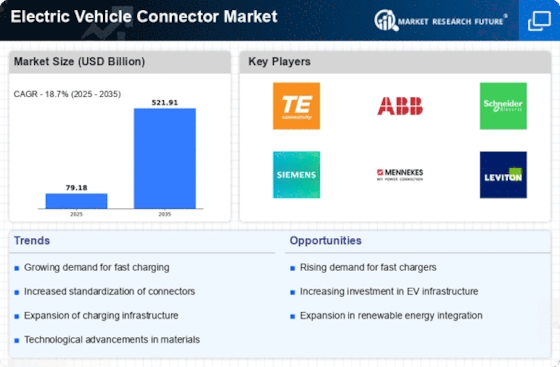

This Research Report provides an in-depth and comprehensive study of the Global Electric Vehicle Connector Market. It outlines the market overview, market segmentation, and related factors influencing its growth. The report also provides a thorough understanding of the economics of electric vehicle connectors, current market trends, and factors driving the growth and restraining forces in the global market.

Research Design

To effectively address the research objectives, the quantitative and qualitative research method is used in this study. International databases, trade journals, white papers, and the internet are the primary sources of data collection. The research design followed is both descriptive and analytic. The research is conducted through a combination of market analysis, primary and secondary data collection, and data validation.

Research Tools

The research tools used to effectively analyze and interpret the collected data include graphical representation in form of charts and graphs, descriptive statistics, and financial indicators. Additionally, various analytical frameworks such as Porter’s Five Forces Analysis, SWOT Analysis, and PESTLE Analysis were used to analyze the factors influencing growth and global market dynamics.

Data Collection

The data collection is done through detailed primary and secondary research. The primary research involves market surveys such as interviews, questionnaires & discussions with industry stakeholders such as suppliers and manufacturers. The primary research is conducted to capture the potential opportunities in the global electric vehicle connector market.

The secondary research includes collecting data from reliable and authenticated sources such as company websites, SEC filings, trade associations, and industry & government documents. It also entailed using internal data sources such as market & customer databases and proprietary databases.

Data Analysis

To analyze the collected data, quantitative and qualitative analysis techniques such as Porter’s 5 Forces Framework, SWOT Analysis and PESTLE Analysis, were used. Additionally, various financial indicators such as market price, total revenue generated, cost structure, gross margins, and yield are used to analyze the economic viability of specific product segments.

Sample Size & Sampling Method

A sample size of 100 electric vehicle connector manufacturers and suppliers is taken to study the market trends and underlying patterns of the industry. A non-probability sampling method, i.e., the convenience sampling method is used for collecting the data. The sample size is carefully chosen to avoid sampling errors and to provide the report with a reliable and meaningful data set.

Data Validation

Data validation involves cross-checking the collected data from different sources to ensure accuracy and consistency. The primary research data is cross-checked with the secondary research data to validate the findings and eliminate any inconsistencies.

Summary

This Research Report provides an in-depth and comprehensive study of the Global Electric Vehicle Connector Market. It outlines the market overview, market segmentation, and related factors influencing its growth. The report also provides a thorough understanding of the economics of electric vehicle connectors, current market trends, and factors driving the growth and restraining forces in the global market. The quantitative and qualitative research method is used in this study. International databases, trade journals, white papers, and the internet are the primary sources of data collection. Data collection is conducted through detailed primary and secondary research and data analysis is done using Porter’s 5 Forces Framework, SWOT Analysis and PESTLE Analysis. A sample size of 100 electric vehicle connector manufacturers and suppliers is used for studying the market trends and a non-probability sampling method is used for collecting the data. Additionally, a data validation process is conducted to cross-check the collected data from different sources to ensure accuracy and consistency.