Emergence of 5G Technology

The emergence of 5G technology is poised to have a profound impact on the Electrical Computer-Aided Design (ECAD) Market. With the rollout of 5G networks, there is an increasing demand for advanced electronic components that can support higher data rates and lower latency. This technological shift necessitates the development of new design tools capable of handling the complexities associated with 5G applications. Market forecasts suggest that the demand for ECAD solutions tailored for 5G technology will grow significantly, potentially exceeding a growth rate of 12% in the coming years. As a result, the Electrical Computer-Aided Design (ECAD) Market is likely to evolve rapidly to meet the challenges posed by this next-generation technology.

Rising Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a significant driver for the Electrical Computer-Aided Design (ECAD) Market. As more devices become interconnected, the complexity of their design increases, necessitating advanced ECAD solutions. The IoT market is projected to grow exponentially, with estimates suggesting a compound annual growth rate of over 25% in the next few years. This rapid expansion creates a pressing need for ECAD tools that can efficiently manage the intricate designs associated with IoT applications. As a result, the Electrical Computer-Aided Design (ECAD) Market is likely to see a substantial increase in demand for specialized design software tailored to IoT requirements.

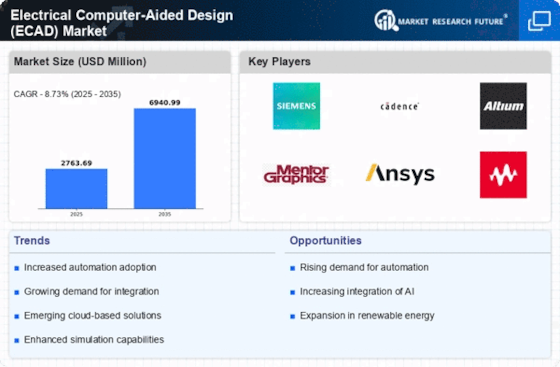

Increasing Demand for Automation

The Electrical Computer-Aided Design (ECAD) Market is experiencing a notable surge in demand for automation tools. As industries strive for efficiency, the integration of automated design processes is becoming essential. Automation not only accelerates the design cycle but also minimizes human error, which is critical in complex electronic systems. According to recent data, the automation segment within the ECAD market is projected to grow at a compound annual growth rate of over 10% in the coming years. This trend indicates a shift towards more sophisticated design tools that can handle intricate tasks with minimal manual intervention, thereby enhancing productivity and innovation in the Electrical Computer-Aided Design (ECAD) Market.

Advancements in Semiconductor Technology

The Electrical Computer-Aided Design (ECAD) Market is significantly influenced by advancements in semiconductor technology. As the demand for smaller, faster, and more efficient electronic devices increases, the need for advanced ECAD tools that can accommodate these innovations becomes paramount. The semiconductor sector is expected to witness a growth rate of approximately 8% annually, driving the need for enhanced design capabilities. This growth compels ECAD software developers to innovate continuously, ensuring that their tools can support the latest semiconductor technologies. Consequently, the Electrical Computer-Aided Design (ECAD) Market is poised for expansion as it adapts to these technological advancements.

Growing Focus on Electronic Design Automation

The Electrical Computer-Aided Design (ECAD) Market is witnessing a growing focus on electronic design automation (EDA) tools. As the complexity of electronic systems escalates, the need for robust EDA solutions becomes increasingly critical. These tools facilitate the design, simulation, and verification of electronic circuits, thereby streamlining the development process. Recent market analyses indicate that the EDA segment is expected to grow at a rate of around 9% annually, reflecting the industry's shift towards more automated and efficient design methodologies. This trend underscores the importance of EDA tools within the Electrical Computer-Aided Design (ECAD) Market, as they play a vital role in enhancing design accuracy and reducing time-to-market.