Top Industry Leaders in the Electronic Access Control Systems Market

The Competitive Landscape of Electronic Access Control Systems Market

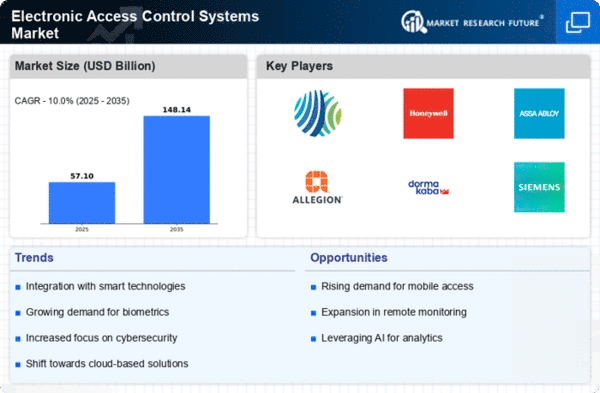

The electronic access control systems (EACS) market is a dynamic sector witnessing robust growth fueled by surging security concerns, technological advancements, and the burgeoning adoption of smart building solutions. This landscape harbors a diverse, multifaceted competition, encompassing industry giants, regional players, and ambitious startups, each vying for market share with distinct strategies and offerings.

Key Players:

- TRUSTSEC

- Johnson Controls International plc

- Allegion plc

- Honeywell Security Group

- Identiv, Inc.

- Nedap N.V.

- Suprema HQ Inc.

- Bosch Security Systems Inc.

- Gemalto N.V.

- NEC Corporation

- IDEMIA

- FINGERPRINTS

- Axis Communications

- Lenel Systems International

- Time and Data Systems International

- AMAG Technology

- Gunnebo

Strategies Adopted by Key Players:

- Innovation & Differentiation: Market leaders like ASSA ABLOY, Dormakaba, Allegion, and Honeywell leverage extensive R&D capabilities to introduce cutting-edge technologies like facial recognition, cloud-based access control, and integrated physical-cyber security solutions. This sets them apart from smaller players and caters to high-end security demands.

- Specialization & Niche Focus: Emerging companies like Brivo, Salto Systems, IDEMIA, and Suprema excel by specializing in specific segments like cloud-based access control for commercial buildings, mobile credentialing, or biometric readers. This targeted approach allows them to gain footholds in specific high-growth areas.

- Cost-Effectiveness & Scalability: Regional players and startups like Nedap, Gunnebo, Amag Technology, and Kisi compete on price sensitivity, offering cost-effective EACS solutions for budget-conscious customers in smaller businesses or residential settings. Their modular and scalable systems cater to varied needs without hefty upfront investments.

- Partnerships & Acquisitions: Strategic partnerships and acquisitions are a key growth strategy. Established players like Johnson Controls or Bosch Security Systems partner with regional specialists or technology providers to expand their reach and product portfolio. Mergers and acquisitions, like ASSA ABLOY's acquisition of HID Global, consolidate market share and enhance capabilities.

Factors for Market Share Analysis:

- Product Portfolio & Technology Breadth: Companies with comprehensive product lines, including hardware, software, and integrated solutions, hold an edge. Offering a spectrum of access control technologies like proximity cards, biometrics, mobile credentials, and advanced integrations with building management systems strengthens market position.

- Geographical Presence & Market Penetration: Global players with established distribution networks and deep regional understanding carve out larger market shares. Companies like Allegion with its strong presence in North America and Europe, or ASSA ABLOY with its global reach, have an advantage over regional players.

- Brand Reputation & Customer Service: Trust and established brand names play a crucial role, especially in security-sensitive sectors. Companies like Dormakaba with its focus on high-security solutions or Honeywell with its legacy in building automation attract larger clients. Providing excellent customer service and post-installation support further solidifies market share.

- Pricing Strategy & Cost Competitiveness: Offering competitive pricing structures is crucial, particularly in budget-driven segments. Balancing quality with affordability helps companies like Nedap or Kisi gain traction in cost-conscious markets. Flexible pricing models like subscription-based services cater to evolving customer needs.

New & Emerging Players:

Several new and emerging companies are disrupting the EACS market with innovative offerings:

- Cloud-Based Solutions: Companies like Brivo and Openpath are leading the charge in cloud-based EACS, offering scalable, remotely manageable systems ideal for multi-location businesses.

- Mobile Credentialing: Startups like Kisi and Verkada are focusing on mobile-first access control, replacing traditional cards with smartphones, simplifying access management and user experience.

- Cybersecurity Integration: Companies like HID Global and Gemalto are integrating physical access control with cybersecurity solutions, creating a holistic security ecosystem for organizations.

Industry Developments

TRUSTSEC:

- June 2022: Announced the release of the TrustSEC Bio Access control card, enabling fingerprint authentication for enhanced security.

- October 2023: Partnered with a major healthcare provider to implement an integrated access control system with visitor management and health screening capabilities.

Johnson Controls International plc:

- September 2023: Acquired CBRE's Global Facilities Management business, strengthening its position in the access control market and expanding its geographic reach.

- November 2023: Launched the Tyco Security Cloud platform, offering cloud-based access control solutions for small and medium-sized businesses.