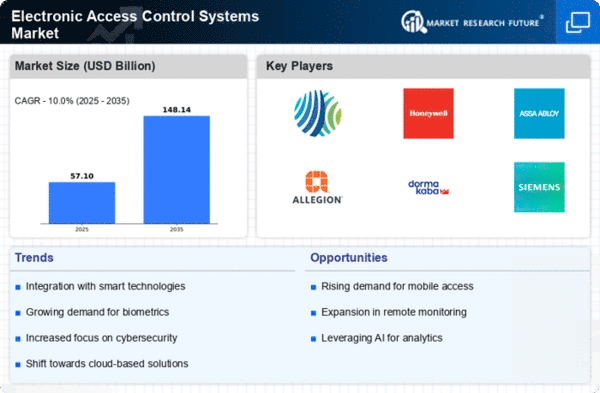

The Electronic Access Control Systems Market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing security concerns across various sectors. Key players such as Johnson Controls (US), Honeywell (US), and ASSA ABLOY (SE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Johnson Controls (US) emphasizes innovation through the integration of smart technologies into their access control solutions, while Honeywell (US) focuses on expanding its digital offerings to cater to the growing demand for remote management capabilities. ASSA ABLOY (SE), on the other hand, is actively pursuing strategic acquisitions to bolster its product portfolio and market reach, thereby shaping a competitive environment that is increasingly reliant on technological sophistication and comprehensive service offerings.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and responsiveness to market demands. The market structure appears moderately fragmented, with a mix of established players and emerging companies vying for market share. This fragmentation allows for diverse offerings, yet the collective influence of key players like Siemens (DE) and Allegion (US) is significant, as they leverage their extensive resources and expertise to set industry standards.

In November 2025, Siemens (DE) announced a partnership with a leading cybersecurity firm to enhance the security features of its access control systems. This strategic move underscores Siemens' commitment to addressing the growing concerns around cybersecurity threats, which are increasingly relevant in the context of digital access solutions. By integrating advanced cybersecurity measures, Siemens aims to differentiate its offerings and build customer trust in an era where data breaches are prevalent.

Similarly, in October 2025, Allegion (US) launched a new line of biometric access control products designed for high-security environments. This introduction reflects Allegion's focus on innovation and its response to the rising demand for more secure and efficient access solutions. The biometric technology not only enhances security but also streamlines user experience, positioning Allegion favorably in a competitive market that values both safety and convenience.

In December 2025, HID Global (US) unveiled a cloud-based access control platform that integrates seamlessly with existing security systems. This development highlights HID's strategic direction towards digital transformation, enabling users to manage access remotely and efficiently. The cloud-based approach is likely to resonate with organizations seeking flexibility and scalability in their security solutions, further intensifying competition in the market.

As of December 2025, the competitive trends in the Electronic Access Control Systems Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver cutting-edge solutions that address evolving security challenges.