Top Industry Leaders in the Embedded System Electric Vehicle Market

Driving the Future: Exploring the Competitive Landscape of Embedded Systems for Electric Vehicles

Beneath the sleek hood of electric vehicles hums a complex orchestra of technology, where the embedded system reigns supreme. This multi-billion dollar market pulsates with diverse players, all vying for a share in orchestrating the delicate dance of power, efficiency, and safety that defines the future of mobility. Let's navigate the key strategies, market dynamics, and future trends shaping this electrifying landscape.

Key Player Strategies:

Global Titans: Companies like Bosch, Continental, and Denso leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major automakers, offering advanced embedded systems encompassing high-performance processors, real-time operating systems, and integrated driver assistance features. Bosch's EMPHASIS system exemplifies their focus on scalable and modular solutions.

Technology Disruptors: Startups like Kalray and Cerebras Systems are disrupting the market with novel technologies like neuromorphic processors for ultra-efficient AI computations, hyper-scalable software platforms for rapid customization, and cloud-based data analytics for predictive maintenance. Kalray's Koolio processor showcases their focus on AI-powered performance optimization.

Cost-Effective Challengers: Chinese manufacturers like BYD and Geely are making waves with competitively priced embedded systems, targeting budget-conscious carmakers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. BYD's in-house developed systems demonstrate their focus on cost-effective performance.

Niche Specialists: Companies like Aptiv and Magna International excel in specific segments, like embedded systems for autonomous driving functions or battery management systems. They leverage deep understanding of specialized requirements and strong relationships with niche technology suppliers. Aptiv's BlueCruise system showcases their focus on advanced driver assistance and autonomous driving solutions.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation embedded systems with faster processors, advanced algorithms for battery management and motor control, and robust cybersecurity architectures is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Functional Safety and Reliability: Ensuring fail-safe operation, minimizing software glitches, and guaranteeing system reliability are paramount for passenger safety and regulatory compliance. Companies with strong track records in safety and reliability gain an edge.

Connectivity and Data Analytics: Integrating embedded systems with cloud platforms, enabling over-the-air software updates, and providing data-driven insights for performance optimization and predictive maintenance create value for automakers and enhance customer experience. Companies embracing connected vehicle solutions cater to the demand for data-driven mobility.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive markets. Companies offering affordable embedded systems without compromising performance or safety stand out.

New and Emerging Trends:

Focus on Artificial Intelligence: Implementing AI algorithms for intelligent energy management, real-time driver behavior analysis, and adaptive cruise control significantly improves performance and safety. Companies embracing AI-powered solutions cater to the growing demand for intelligent vehicles.

Standardization and Open Platforms: Developing industry-wide standards for embedded systems and promoting open platforms for software development create greater flexibility and accelerate innovation. Companies supporting open platforms cater to the collaborative approach in the EV ecosystem.

Focus on Cybersecurity: Securing embedded systems against cyberattacks and ensuring data privacy are critical for system integrity and consumer trust. Companies with robust cybersecurity solutions gain an edge in this increasingly connected landscape.

Expansion into Commercial and Heavy-Duty Vehicles: Growing adoption of electric trucks, buses, and other commercial vehicles presents significant opportunities for embedded system suppliers. Companies adapting their solutions to these segments stand to benefit from market diversification.

Overall Competitive Scenario:

The embedded system for electric vehicles market is a dynamic and exciting space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific segments. Factors like technology innovation, safety, connectivity, and affordability play a crucial role in market share analysis. New trends like AI, standardization, cybersecurity, and expansion into new vehicle segments offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse vehicle needs, embrace data-driven solutions, and prioritize robust cybersecurity. By orchestrating the symphony of power, efficiency, and safety within electric vehicles, they can secure a dominant position in this high-voltage landscape.

Industry Developments and Latest Updates:

Robert Bosch:

October 26, 2023: Partnered with LiDAR startup Quanergy for high-resolution sensors in autonomous EVs.

December 12, 2023: Unveiled enhanced radar sensor for improved pedestrian and cyclist safety in EVs.Continental AG:

November 15, 2023: Partnered with Intel on a sensor fusion platform for autonomous driving in EVs.

December 5, 2023: Acquired US-based radar technology company Odas Munro, expanding their EV sensor portfolio.

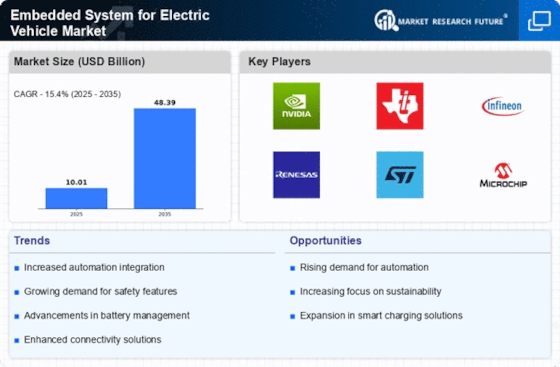

Top Companies in the Embedded System for Electric Vehicle industry includes,

Robert Bosch

Continental AG

Panasonic

Texas Instruments

Mitsubishi Electric

DENSO