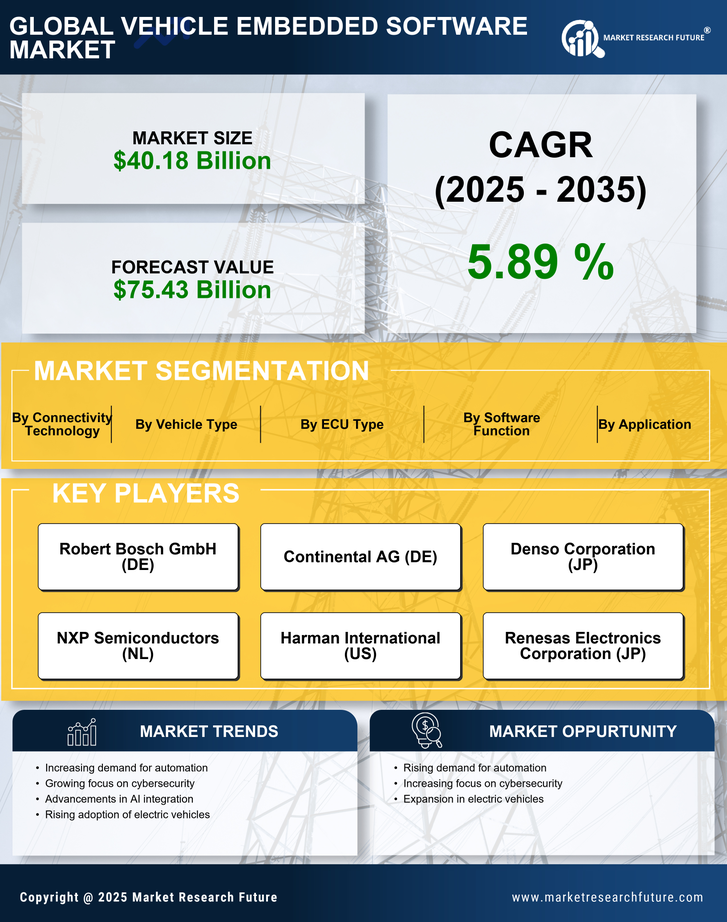

Growth of Electric and Autonomous Vehicles

The transition towards electric and autonomous vehicles is significantly influencing the Vehicle Embedded Software Market. As automakers invest heavily in electric vehicle (EV) technology, the need for advanced embedded software to manage battery systems, energy efficiency, and vehicle-to-grid communication becomes paramount. Additionally, the rise of autonomous driving technologies requires sophisticated software algorithms capable of processing sensor data and making real-time decisions. Market analysis indicates that the electric vehicle segment is expected to witness a growth rate exceeding 25% annually, which will likely drive demand for specialized embedded software solutions. This shift not only enhances the driving experience but also aligns with global sustainability goals, thereby reinforcing the importance of embedded software in the evolving automotive landscape.

Increased Connectivity and IoT Integration

The proliferation of connectivity features and the integration of Internet of Things (IoT) technologies are reshaping the Vehicle Embedded Software Market. As vehicles become more connected, the demand for software that facilitates communication between vehicles, infrastructure, and mobile devices is on the rise. This connectivity enables features such as real-time traffic updates, remote diagnostics, and enhanced infotainment systems. Recent statistics suggest that the connected car market is anticipated to grow at a rate of approximately 15% per year, underscoring the necessity for advanced embedded software solutions. Moreover, the integration of IoT technologies allows for improved data collection and analysis, which can lead to better vehicle performance and user experience, further driving the growth of the Vehicle Embedded Software Market.

Regulatory Compliance and Safety Standards

Regulatory compliance and adherence to safety standards are critical drivers in the Vehicle Embedded Software Market. Governments worldwide are implementing stringent regulations aimed at enhancing vehicle safety and reducing emissions. This regulatory landscape compels manufacturers to invest in advanced embedded software solutions that ensure compliance with safety protocols and environmental standards. For instance, the implementation of the Euro 6 emissions standard has necessitated the development of sophisticated software to manage engine performance and emissions control systems. As a result, the Vehicle Embedded Software Market is likely to experience increased demand for software that not only meets regulatory requirements but also enhances vehicle performance and safety. This trend indicates a growing recognition of the importance of embedded software in achieving compliance and maintaining competitive advantage.

Rising Demand for Advanced Driver Assistance Systems

The increasing demand for Advanced Driver Assistance Systems (ADAS) is a pivotal driver in the Vehicle Embedded Software Market. As consumers seek enhanced safety features, manufacturers are integrating sophisticated software solutions to support functionalities such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking. According to recent data, the ADAS segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This surge in demand necessitates robust embedded software solutions that can process vast amounts of data in real-time, thereby propelling the growth of the Vehicle Embedded Software Market. Furthermore, regulatory pressures aimed at improving road safety are likely to further accelerate the adoption of these technologies, creating a favorable environment for embedded software development.

Consumer Preference for Enhanced In-Vehicle Experience

Consumer preferences are shifting towards an enhanced in-vehicle experience, which serves as a significant driver in the Vehicle Embedded Software Market. Modern consumers expect their vehicles to offer seamless connectivity, advanced infotainment systems, and personalized features. This demand for a superior in-vehicle experience is prompting automakers to invest in innovative embedded software solutions that cater to these expectations. Market Research Future indicates that the in-vehicle infotainment market is projected to grow at a rate of around 10% annually, reflecting the increasing importance of software in delivering a satisfying user experience. As automakers strive to differentiate their offerings, the development of sophisticated embedded software becomes essential, thereby propelling the growth of the Vehicle Embedded Software Market.