Rising Energy Costs

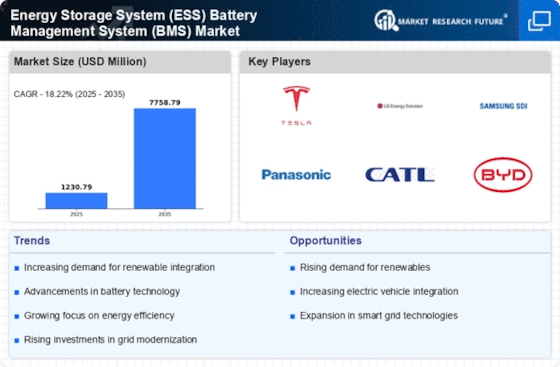

The escalating costs of energy are prompting a shift towards Energy Storage System (ESS) Battery Management System (BMS) Market solutions. As energy prices continue to rise, both consumers and businesses are seeking ways to mitigate these expenses. Energy storage systems provide a viable solution by allowing users to store energy during off-peak hours when prices are lower and utilize it during peak demand periods. This not only leads to cost savings but also enhances energy independence. Market analysis indicates that the demand for energy storage solutions is likely to increase as more stakeholders recognize the financial benefits associated with effective energy management through advanced BMS technologies.

Integration with Smart Grids

The integration of Energy Storage System (ESS) Battery Management System (BMS) Market with smart grids is becoming increasingly vital. Smart grids facilitate the efficient management of energy distribution, allowing for real-time monitoring and control. This integration enhances the reliability and efficiency of energy systems, particularly in urban areas where energy demand fluctuates. As cities expand, the need for robust energy management solutions grows. The ESS BMS plays a crucial role in optimizing energy storage and usage, thereby supporting the transition to smart grid technologies. According to recent data, the smart grid market is projected to reach substantial growth, which in turn is likely to drive the demand for advanced BMS solutions in the ESS sector.

Increased Focus on Sustainability

The growing emphasis on sustainability is significantly influencing the Energy Storage System (ESS) Battery Management System (BMS) Market. As environmental concerns become more pronounced, industries are seeking ways to reduce their carbon footprints. Energy storage systems are integral to this transition, enabling the integration of renewable energy sources and enhancing energy efficiency. Companies are increasingly investing in BMS technologies that support sustainable practices, such as optimizing battery life and reducing waste. This trend is expected to drive innovation within the market, as stakeholders prioritize eco-friendly solutions. The alignment of BMS advancements with sustainability goals is likely to create new opportunities for growth in the ESS sector.

Regulatory Support and Incentives

Regulatory frameworks and government incentives are increasingly shaping the Energy Storage System (ESS) Battery Management System (BMS) Market. Many governments are implementing policies that promote the adoption of energy storage technologies, recognizing their potential to enhance energy security and reduce greenhouse gas emissions. For instance, tax credits and subsidies for energy storage installations are becoming more common, encouraging businesses and consumers to invest in these systems. This regulatory support not only boosts market growth but also fosters innovation within the BMS sector, as companies strive to meet evolving standards and requirements. The presence of favorable regulations is expected to significantly influence market dynamics in the coming years.

Technological Advancements in Energy Storage

Technological advancements are a key driver of the Energy Storage System (ESS) Battery Management System (BMS) Market. Innovations in battery technologies, such as lithium-ion and solid-state batteries, are enhancing the performance and efficiency of energy storage systems. These advancements not only improve energy density and lifespan but also reduce costs, making energy storage more accessible. As technology continues to evolve, the capabilities of BMS solutions are expanding, allowing for better monitoring, control, and optimization of energy storage systems. Market forecasts suggest that the ongoing development of cutting-edge technologies will play a crucial role in shaping the future landscape of the ESS BMS market.