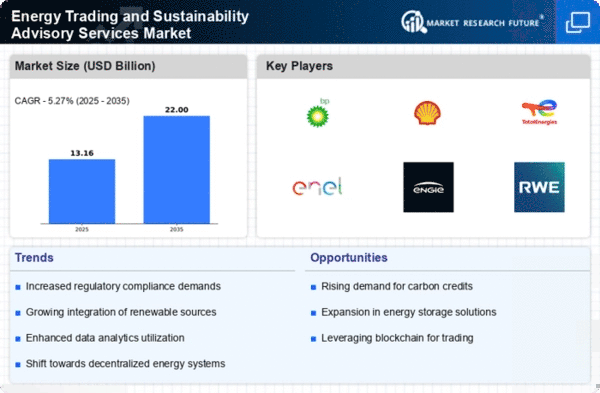

The Energy Trading and Sustainability Advisory Services Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for renewable energy solutions and the imperative for companies to enhance their sustainability profiles. Major players such as BP (GB), Shell (GB), and TotalEnergies (FR) are actively positioning themselves through strategic initiatives that emphasize innovation and digital transformation. For instance, BP (GB) has been focusing on integrating advanced analytics into its trading operations, which appears to enhance decision-making processes and optimize energy trading strategies. Meanwhile, Shell (GB) is pursuing a strategy of regional expansion, particularly in emerging markets, to capitalize on the growing appetite for sustainable energy solutions. Collectively, these strategies contribute to a competitive environment that is increasingly shaped by technological advancements and a commitment to sustainability.In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure is moderately fragmented, with a mix of established players and new entrants vying for market share. The collective influence of key players is significant, as they leverage their resources and expertise to drive innovation and establish competitive advantages.

In November TotalEnergies (FR) announced a strategic partnership with a leading technology firm to develop AI-driven solutions for energy trading. This collaboration is poised to enhance TotalEnergies' capabilities in predictive analytics, potentially allowing for more accurate forecasting of energy prices and demand patterns. Such advancements could significantly improve operational efficiency and profitability in a highly competitive market.

In October Shell (GB) launched a new sustainability advisory service aimed at helping corporate clients transition to net-zero emissions. This initiative not only reinforces Shell's commitment to sustainability but also positions the company as a leader in providing advisory services that align with global climate goals. The strategic importance of this move lies in its potential to attract a broader client base seeking to enhance their sustainability credentials.

In September Enel (IT) expanded its renewable energy portfolio by acquiring several solar projects in Latin America. This acquisition is indicative of Enel's strategy to diversify its energy sources and strengthen its position in the renewable sector. The strategic importance of this expansion is underscored by the growing demand for clean energy solutions in the region, which could yield substantial long-term benefits for the company.

As of December the competitive trends in the Energy Trading and Sustainability Advisory Services Market are increasingly defined by digitalization, sustainability initiatives, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, sustainability, and supply chain reliability, reflecting the changing priorities of consumers and businesses alike.