Expansion in the Automotive Sector

The automotive industry plays a pivotal role in the Epichlorohydrin Market, with increasing utilization of epichlorohydrin-based materials in various applications such as coatings, adhesives, and sealants. The demand for lightweight and durable materials is driving manufacturers to incorporate epichlorohydrin into their production processes. In 2025, the automotive segment is expected to witness a growth rate of around 4.8%, reflecting the industry's ongoing transformation towards more efficient and sustainable vehicles. This expansion is further supported by the rising consumer preference for electric vehicles, which often require advanced materials for enhanced performance and safety. As automotive manufacturers continue to innovate, the reliance on epichlorohydrin is likely to intensify, thereby propelling the overall market forward.

Growth in the Construction Industry

The construction sector is a significant driver of the Epichlorohydrin Market, as the demand for high-performance materials continues to rise. Epichlorohydrin Market is increasingly used in the production of sealants, coatings, and adhesives, which are essential for modern construction projects. In 2025, the construction industry is projected to contribute substantially to the market, with an anticipated growth rate of approximately 5.5%. This growth is attributed to the ongoing urbanization and infrastructure development initiatives worldwide, which necessitate the use of durable and efficient materials. Additionally, the trend towards sustainable building practices is likely to enhance the appeal of epichlorohydrin-based products, as they offer improved performance while aligning with environmental standards.

Regulatory Support for Chemical Safety

The regulatory landscape surrounding chemical safety is evolving, and this is impacting the Epichlorohydrin Market. Governments are increasingly implementing stringent regulations aimed at ensuring the safe use of chemicals in various applications. In 2025, compliance with these regulations is expected to drive innovation and investment in safer alternatives and production methods. This regulatory support may encourage manufacturers to enhance their product offerings, focusing on safety and environmental impact. As a result, the epichlorohydrin market could see a shift towards more sustainable practices, with companies striving to meet regulatory requirements while maintaining product performance. This dynamic may ultimately foster a more responsible and forward-thinking industry.

Rising Demand in Adhesives and Sealants

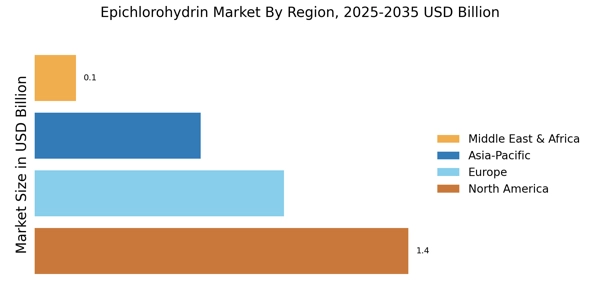

The Epichlorohydrin Market is experiencing a notable surge in demand for adhesives and sealants, primarily driven by the construction and automotive sectors. These industries increasingly utilize epichlorohydrin-based products due to their superior bonding properties and resistance to environmental factors. In 2025, the adhesives segment is projected to account for a significant share of the market, reflecting a compound annual growth rate (CAGR) of approximately 5.2% from 2023 to 2025. This trend indicates a robust growth trajectory, as manufacturers seek high-performance materials that enhance product durability and longevity. Furthermore, the shift towards eco-friendly formulations is likely to bolster the adoption of epichlorohydrin in these applications, as companies strive to meet sustainability goals while maintaining product efficacy.

Technological Innovations in Production

Technological advancements in the production of epichlorohydrin are significantly influencing the Epichlorohydrin Market. Innovations such as improved synthesis methods and enhanced purification processes are leading to higher yields and reduced production costs. In 2025, these advancements are expected to facilitate a more efficient supply chain, thereby increasing the availability of epichlorohydrin for various applications. Furthermore, the development of novel catalysts and reaction conditions may enhance the overall sustainability of the production process, aligning with the industry's shift towards greener practices. As manufacturers adopt these technologies, the market is likely to witness a transformation, characterized by increased competitiveness and a broader range of applications for epichlorohydrin.

Leave a Comment