Regulatory Environment and Compliance

The regulatory environment plays a crucial role in shaping the Equity Indexed Life Insurance Market. As governments and regulatory bodies implement new guidelines and standards, insurers must adapt their products to remain compliant. Recent changes in regulations have focused on transparency and consumer protection, which have led to increased scrutiny of equity indexed products. Insurers are now required to provide clearer disclosures regarding the risks and benefits associated with these policies. This evolving regulatory landscape may initially pose challenges for insurers, but it also presents opportunities for those who can effectively navigate compliance requirements. By ensuring adherence to regulations, companies can build consumer trust and enhance their reputation in the Equity Indexed Life Insurance Market.

Increased Focus on Retirement Planning

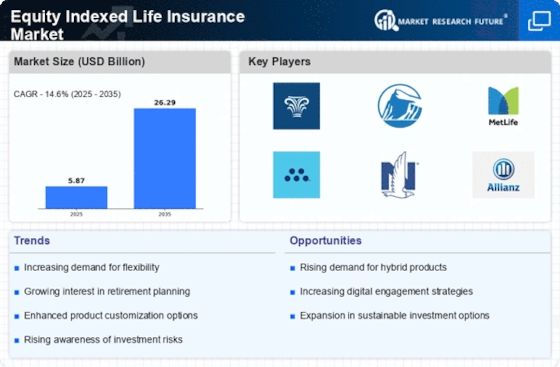

The Equity Indexed Life Insurance Market is witnessing a heightened focus on retirement planning among consumers. As individuals recognize the importance of securing their financial future, they are increasingly turning to equity indexed life insurance as a viable option. This product not only provides a death benefit but also accumulates cash value that can be accessed during retirement. According to recent data, nearly 40% of consumers express a preference for insurance products that offer both protection and investment growth. This trend is likely to drive the market forward, as more people seek to balance their insurance needs with their long-term financial goals. The integration of equity market performance into life insurance products aligns well with the evolving landscape of retirement planning, making the Equity Indexed Life Insurance Market a focal point for financial advisors and consumers alike.

Rising Demand for Flexible Financial Products

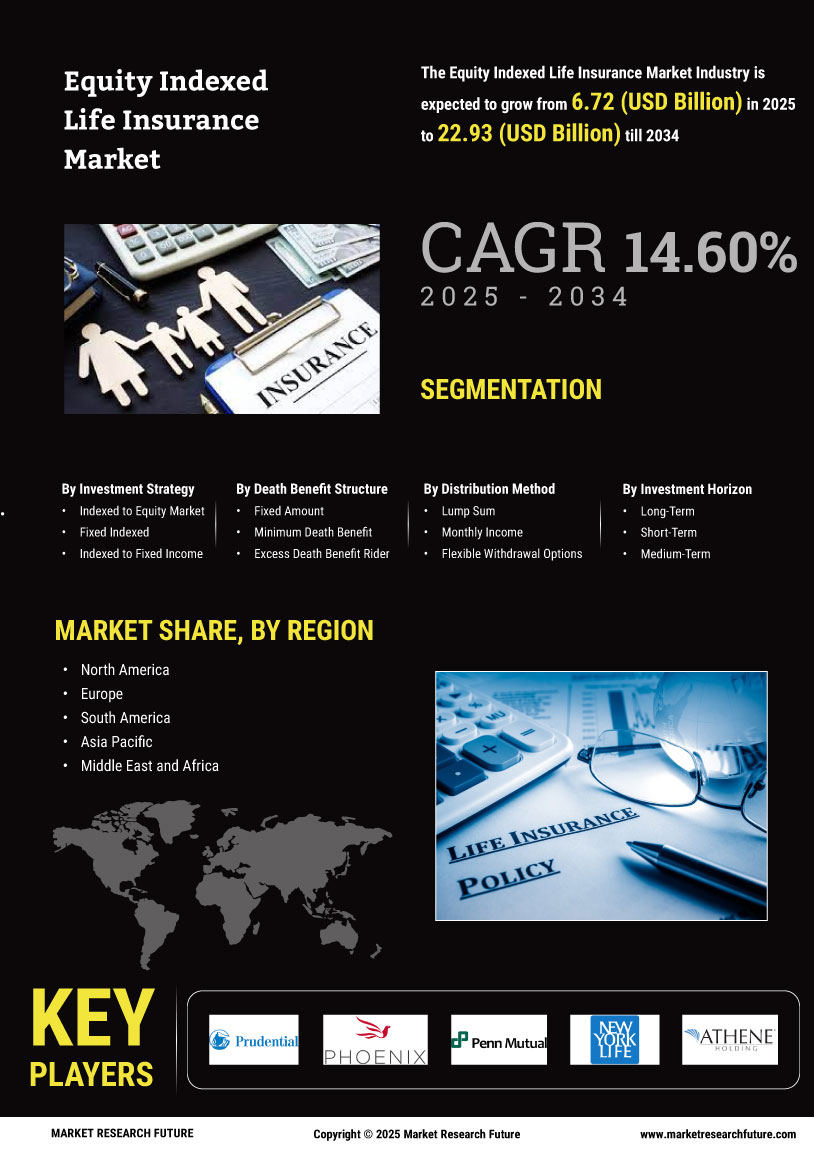

The Equity Indexed Life Insurance Market is experiencing a notable increase in demand for flexible financial products. Consumers are increasingly seeking insurance solutions that not only provide death benefits but also offer growth potential linked to equity market performance. This trend is driven by a growing awareness of the need for financial security and wealth accumulation. As individuals become more financially literate, they are gravitating towards products that allow them to participate in market gains while enjoying the safety of a life insurance policy. In 2025, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5%, reflecting this shift in consumer preferences. Insurers are responding by innovating their offerings to include more customizable options, thereby enhancing their competitive edge in the Equity Indexed Life Insurance Market.

Technological Advancements in Insurance Solutions

Technological advancements are significantly influencing the Equity Indexed Life Insurance Market. The integration of digital platforms and data analytics is transforming how insurers design, market, and manage their products. Insurers are leveraging technology to enhance customer experience, streamline underwriting processes, and improve risk assessment. For instance, the use of artificial intelligence and machine learning allows for more accurate pricing models and personalized product offerings. In 2025, it is estimated that technology-driven solutions will account for over 30% of new policy sales in the Equity Indexed Life Insurance Market. This shift not only improves operational efficiency but also enables insurers to better meet the evolving needs of consumers, thereby fostering growth in the market.

Growing Interest in Alternative Investment Strategies

The Equity Indexed Life Insurance Market is benefiting from a growing interest in alternative investment strategies among consumers. As traditional investment avenues face volatility, individuals are increasingly looking for products that offer stability and growth potential. Equity indexed life insurance provides a unique solution by combining life insurance protection with the opportunity to earn interest based on the performance of a stock market index. This dual benefit appeals to consumers who are cautious about market fluctuations yet desire some exposure to equity growth. In 2025, it is projected that the share of equity indexed products in the overall life insurance market will rise, reflecting this shift in investment preferences. The Equity Indexed Life Insurance Market is thus positioned to capitalize on this trend, attracting a diverse range of consumers seeking innovative financial solutions.