Research Methodology on the Global Ethernet Switch Market

Market Research Future (MRFR) estimates that the Global Ethernet Switch Market is likely to register a significant growth rate from 2023 to 2030. MRFR has employed a systematic yet thorough process in gathering the data, conducting market estimation, and writing a meaningful and reliable report on the Ethernet Switch Market.

1. Introduction

The research process begins with an introduction section that seeks to offer a comprehensive background to the study. This part of the report introduces readers to the concept of an Ethernet switch, examines the global market state and important participants in the Ethernet Switch space, and outlines global trends and their impact on the global Ethernet switch market during the assessment period 2023 to 2030.

2. Research Objectives

The second section of the research project seeks to outline the specific aims and objectives of the study. It links in with the introduction of the report and outlines in depth the main areas that the research study is designed to probe.

The research objectives for the Global Ethernet Switch Report are:

- To estimate the global market size of Ethernet switches during the assessment period.

- To provide an overview of key players and their strategies in the Ethernet switch market.

- To analyze the drivers, challenges, and opportunities impacting the growth of the market.

- To analyze the impact of regulatory policies on the market development

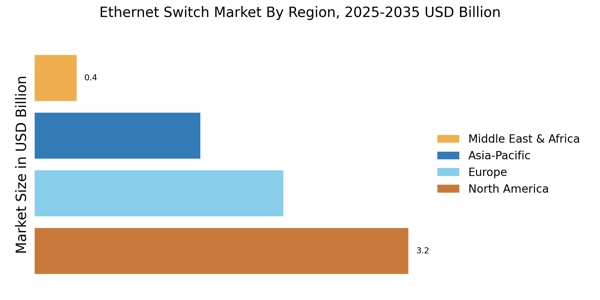

- To provide a regional analysis of the global Ethernet switch market

3. Research Methodology

The third part of the report elucidates the research methodology employed in the overall research project. It defines the various set of primary and secondary sources employed in collecting and analyzing data.

3.1 Primary Research

The primary research phase involves collecting information for the research project through various means such as interviews with industry professionals, prominent market players and studies involving the process industry.

3.2 Secondary Research

The secondary research phase involves collecting and evaluating data from various sources such as newspapers, annual reports, journals, industry magazines, industry-specific databases, and other reliable sources.

4. Market Segmentation

The fourth section of the report segments the Global Ethernet Switch Market based on product type, technology, end-user vertical, and region.

5. Market Size Estimation Through Quantitative and Qualitative Techniques

The fifth section of the report covers both qualitative and quantitative methods for computing the market size. This aspect of the report looks at the overall market size through market share analysis based on economic modelling and surveys from industry professionals.

6. Data Collection

The sixth section of the report looks at the collection of data from both primary and secondary sources. The data is collected from genuine sources and authenticated to ensure the quality of information presented in the report.

7. Statistical Analysis

The seventh section of the report includes the statistical analysis of data collected through surveys, interviews, and quantitative methods. The analysis is conducted using analytics tools such as mean, mode, weighted averages, and standard deviation.

8. Report Significance

The eighth section of the report answers the question of why this report has value for the investor. It examines the relevance of the report and the key findings for understanding the various facets of the Ethernet Switch market.

9. Code of Ethics

The nineth section explores the ethical code of conduct applied by Market Research Future in carrying out the research project. This aspect of the report demonstrates the commitment of the research service provider to delivering accurate and reliable reports to its clients in the shortest possible timeframe.