Market Analysis

In-depth Analysis of Ethylene Tetrafluoroethylene (ETFE) Market Industry Landscape

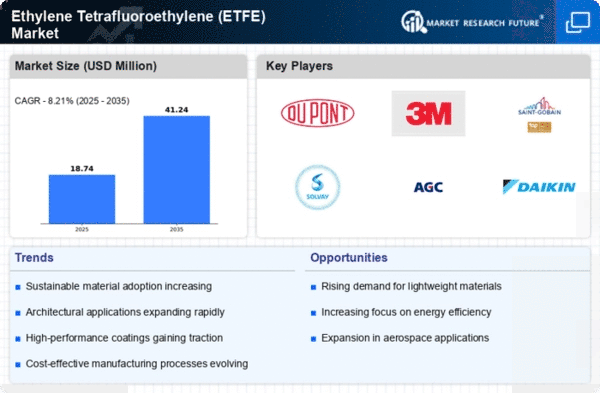

The Ethylene Tetrafluoroethylene (ETFE) market has exhibited changing dynamics due to various supply side and demand factors affecting it. It is one of fluorine-based polymers having remarkable features like high chemical resistance; excellent thermal stability coupled with good electrical insulation ability making it gain popularity across different sectors. Furthermore, one of the key driving factors behind changes in the industry is an increasing demand for lightweight and durable materials within construction including applications related to architecture such as cladding systems. The Eden project built using ETFE in UK architecture sets a precedent for similar projects throughout the world.

Also contributing to market growth is the increased adoption of ETFE by automotive industry stakeholders. This material enables automakers reduce vehicle mass while maintaining their strength levels without compromising safety standards hence reducing fuel consumption levels hence lowering emissions as well.. As a result of this trend towards sustainability initiatives by manufacturers engaged in car manufacturing activities ETPE offers a suitable choice.

Global strategies aimed at renewable energy sources and green technology also create certain trends within ETFE sector’s development. Owing to its transparency together with UV resistance, this material is favorable for manufacturing solar panels. It is anticipated that the demand for ETFE in solar panel applications will steadily grow as countries switch to cleaner alternatives for energy.

The competitive landscape of this market is characterized by continuous research and development initiatives aimed at improving the properties of ETFE and expanding its application areas. Innovations that are being developed are focusing on coming up with more advanced ETFEs for particular industries. Such innovation-based competition keeps the industry vibrant.

Furthermore, there are regional economic trends, infrastructure developments and regulatory frameworks which influence market dynamics geographically. As emerging economies experience rapid urbanization together with infrastructure projects, they increase their demand for ETFE used in construction industry. At the same time, mature markets have some architectural landmarks calling for renovation or modernization works through use of ETFE.

Availability as well as prices of raw materials also determines how ETFE market behaves in terms of pricing structures. The production processes involve various petrochemical feedstock inputs into which a range of raw materials derived from petroleum products are introduced. Oil price changes coupled with geopolitical happenings usually influence costs associated with these raw materials thereby affecting overall pricing structure related to ETFE. Manufacturers follow these trends so as to be competitive hence continuously revising savings rates accordingly.

In addition, the market dynamics of fluropolymers are also influenced by environmental concerns and regulations. As a result of this, there is need for new production methods as well as eco-friendly formulations for ETFE to be considered by many manufacturers since sustainability is becoming more important across industries worldwide. This means that following strict environmental laws is crucial in changing market dynamics which impact output processes and product strategies.

Leave a Comment